Cisco’s Acquisitions Drive Its Collaboration Revenues

Earlier in 2016, Cisco completed the acquisition of European video conferencing startup Acano for $700 million in cash.

June 28 2016, Updated 7:04 p.m. ET

Rising need to collaborate operational functions

Collaboration helps individuals work together and achieve a common business purpose. It can be synchronous, wherein everyone interacts in real-time online meetings, instant messaging, and video conferencing, or it can be asynchronous.

According to Cisco, businesses are growing at a rapid pace and the communication process is becoming more complex. These businesses find it increasingly valuable to collaborate with respect to their operational functions.

Major players in the collaboration business

According to Synergy Research Group, Cisco Systems (CSCO) is the market leader in the collaboration segment, with a share of more than 16%. Microsoft (MSFT) and Avaya follow with shares of 13% and 4%, respectively, at the end of 4Q15.

Earlier in 2016, Cisco completed the acquisition of European (EFA) (FEP) video conferencing startup Acano for $700 million in cash. Acano is involved in the development of video infrastructure and collaboration software that allows end users to connect video systems from different vendors across both cloud and hybrid environments.

Cisco also acquired video conferencing firm Tandberg in 2010 for $3.3 billion and online meeting service company WebEx Communications for $3.2 billion in 2007.

Cisco’s (CSCO) Collaboration business saw revenues rise by 10% YoY (year-over-year) in fiscal 3Q16. Revenues in this segment rose from $972 million in fiscal 3Q15 to $1.1 billion in fiscal 3Q16.

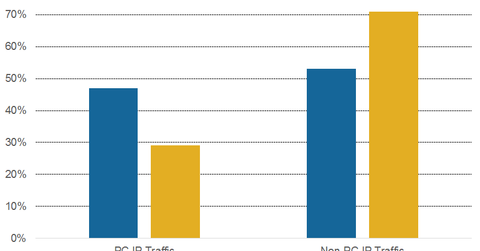

According to Cisco’s annual report, key drivers in the enterprise collaboration space include rapidly evolving communication standards, an increase in the amount of data flowing for communication, and hyperconnectivity to the Internet.

Research firm MarketsandMarkets states that the enterprise collaboration market is expected to grow from $47.3 billion in 2014 to $70.6 billion in 2019.

The next article will focus on Microsoft’s acquisition of LinkedIn (LNKD) and its potential acquisition of Slack.