PVH Delivered a Solid 4Q15 on Strong Calvin Klein Performance

PVH Corp. (PVH) registered a 2.1% year-over-year increase in its top line in fiscal 4Q15, which ended January 31, 2016, to $2.1 billion.

May 23 2016, Published 3:09 p.m. ET

Snapshot of PVH’s performance in fiscal 4Q15

PVH Corp. (PVH) registered a 2.1% YoY (year-over-year) increase in its top line in fiscal 4Q15, which ended January 31, 2016, to $2.1 billion. This increase was primarily driven by an ~15% increase in sales of the Calvin Klein segment.

The increase in the Calvin Klein segment was partially offset by an ~2% decline in Tommy Hilfiger’s revenue and an ~10% decline in Heritage Brands’s revenue.

Calvin Klein, the key driver of PVH’s fiscal 4Q15 revenue

The Calvin Klein segment registered a 21% YoY increase on a constant currency basis. It also had a 15% YoY increase on a GAAP[1. generally accepted accounting principles] basis to $806 million in fiscal 4Q15. The strong growth was driven by an 18% increase in Calvin Klein North America;s sales and a 10% increase in Calvin Klein International’s revenue.

The company’s North America sales were primarily driven by growth in excess of 20% in its wholesale business, which was due to continued strength in the Underwear segment. International sales were driven by strong growth in Europe and China, partially benefited by the Chinese New Year.

Tommy Hilfiger sales

Revenue from the Tommy Hilfiger business increased by 5% on a constant currency basis and decreased by 2% on a GAAP basis to $904 million in fiscal 4Q15. Tommy Hilfiger’s North America revenue decreased by 1% on a GAAP basis as growth in the wholesale business was mostly offset by softness in the retail business.

The company’s North America retail comparable store sales fell by 7% in 4Q15. This decrease was driven by continued weakness in traffic and consumer spending trends in Tommy Hilfiger’s US stores located in international tourist locations. This represents a significant portion of the business.

Tommy Hilfiger’s International revenue decreased by 2% on a GAAP basis as strong performance in European markets were offset by the negative effect of changes in exchange rates. On a constant currency basis, this segment registered an 8% growth, which included a 10% increase in retail comparable store sales and healthy growth in the wholesale business.

Heritage Brands registered sales decline on continued rationalization

Revenue from the Heritage Brands business decreased by 10% during the quarter, primarily due to the continued rationalization of the Heritage Brands business. This included the exit from the Izod retail business and the discontinuation of several licensed product lines in the Dress Furnishings business.

The Van Heusen retail business, however, remained strong and registered an 8% increase in comparable store sales.

Comparing PVH with other apparel and accessory companies

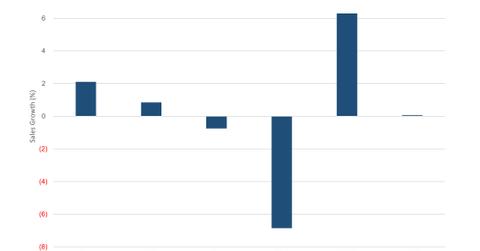

Many of PVH Corp.’s apparel and accessory competitors have recorded falling or stagnant sales growth during their last reported quarters. Hanesbrands (HBI) and VF Corp. (VFC) registered sales increases of 0.8% and 0.07%, respectively. Gap (GPS) and Ralph Lauren (RL) reported declines of 6.8% and 0.7%, respectively, in their last reported quarters.

ETF investors seeking to add exposure to PVH can consider the iShares Morningstar Mid-Cap ETF (JKG), which invests 0.48% of its portfolio in PVH.

Read the next part of this series to learn about PVH’s profitability and margins in fiscal 4Q16.