Should We Expect General Electric to Raise Dividends in 2017?

For a long time, General Electric (GE) has remained a decent dividend distributor in the S&P 500 space. The company raised its dividend per share by $0.01 to $0.24 in January 2017.

April 18 2017, Updated 9:06 a.m. ET

General Electric and dividends

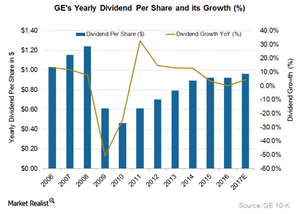

For a long time, General Electric (GE) has remained a decent dividend distributor in the S&P 500 space. The company raised its dividend per share by $0.01 to $0.24 in January 2017. This amount translates to an annualized dividend per share of $0.96.

For consecutive two years ending in 2016, the company’s dividend per share was $0.92.

GE’s dividend yield

General Electric aims for dividend growth along with earnings growth. The company also expects a higher dividend yield than those of other S&P 500 companies. GE has a dividend yield of 3.2%, which isn’t really attractive. Let’s take a look at its peers’ dividend yields.

Honeywell International (HON), a well-known name in the Aerospace industry, has a dividend yield of 2.2%. United Technologies (UTX), a supplier of high-end technological products to worldwide aerospace industries, has a dividend yield of 2.4%. Another big name in the industrial technology, 3M Company (MMM) has a dividend yield of 2.5%.

Investors interested in indirectly holding GE may want to invest in the iShares Global Industrials ETF (EXI). GE makes up 6.6% of the portfolio holdings of EXI.

GE’s free cash flow

Free cash flow (or FCF) is calculated by deducting capital expenditure from operating cash flow. Normally, a company uses its remaining cash to pay its dividends, buy back its shares, or reinvest in its business. GE’s free cash flow entered into negative territory in 2016, but it had been positive until 2015. There’s a huge gap between its dividends paid and its free cash flow.

FCF is an important factor for a heavy payout company such as GE. By looking at GE’s cash flow, one might conclude that the company’s ability to finance its dividends with FCF has severely deteriorated over the last several years. Having said this, Market Realist feels that GE’s dividend growth could take a hit in the quarters to come.

General Electric has decided to sell its consumer lighting business. Read on to know why.