Why Israel’s Economy Is Still Resilient

Israel’s government debt as a proportion of gross national product has declined steadily this century.

Feb. 24 2016, Updated 12:04 a.m. ET

3. Energy Independence

The future health of the Israeli economy received a substantial boost in 2009 with the discovery of substantial natural gases reserves offshore. The largest of these discoveries, the Leviathan field in the Levant basin, contains an estimated 16 trillion cubic feet of gas.

Israel is expected to become an energy exporter by the end of this decade and the government is planning to establish a sovereign wealth fund to ensure that the windfall proceeds from this unanticipated source of public revenue are wisely invested.

4. A Resilient, Growing Economy

The country’s economy displayed great resilience during the worldwide economic crisis, growing by 1.3% in 2009 while other economies were contracting sharply. This reflected structural differences in the Israeli economy that set it apart from many others. The country’s banks were relatively well capitalized and steep deposit requirements for would-be homeowners prevented the development of a debt financed housing bubble of the kind that occurred in the United States.

Also worth noting is that Israel’s government debt as a proportion of gross national product has declined steadily this century, to 67.6% in 2014 from 96.7% in 1998, according to the Bank of Israel.

Market Realist – Israel’s economy remains resilient.

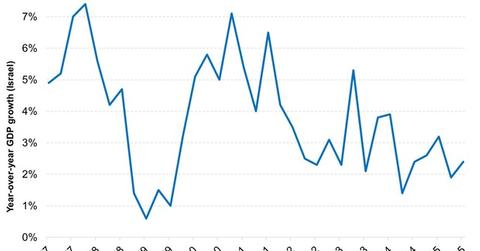

Israel (ISL)(EIS) boasts a resilient economy. As you can see from the graph above, the economy didn’t slump into a recession in 2009, unlike most other developed markets (VEA)(EFA). Since 2010, Israel’s average year-over-year GDP growth rate has been 3.7%, which is pretty solid. The service sector accounts for as much as 80% of the country’s GDP. Plus, Israel is a relatively young country with a median age of ~30, and this boosts its economy.

Israel’s government debt as a percentage of its GDP has steadily fallen over the past decade. It stood at 65.9% in 2015 versus 104% in 2004. Other developed economies have much higher ratios. Japan’s (JEQ) debt-to-GDP ratio is a stunning 242%. The lower ratio allows the government to spend on things other than debt servicing, which can boost Israel’s economy.

This article was originally published for MarketViews by dianomi ltd

IMPORTANT INFORMATION

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS

Closed-end funds are traded on the secondary market through one of the stock exchanges. The Fund’s investment return and principal value will fluctuate so that an investor’s shares may be worth more or less than the original cost. Shares of closed-end funds may trade above (a premium) or below (a discount) the net asset value (NAV) of the fund’s portfolio. The Net Asset Value (NAV) is the value of an entity’s assets less the value of its liabilities. The Market Price is the current price at which an asset can be bought or sold. There is no assurance that the Fund will achieve its investment objective.

International investing entails special risk considerations, including currency fluctuations, lower liquidity, economic and political risks, and differences in accounting methods. These risks may be enhanced in emerging markets countries. Concentrating investments in the Israel region subjects a Fund to more volatility and greater risk of loss than geographically diverse funds. Equity stocks of small and mid-cap companies carry greater risk, and more volatility than equity stocks of larger, more established companies.

Source: MSCI. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI” Parties) expressly disclaims all warranties (including without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages (www.msci.com).

In the United States, AAM is the marketing name for the following affiliated, registered investment advisers: Aberdeen Asset Management Inc., Aberdeen Asset Managers Ltd, Aberdeen Asset Management Ltd and Aberdeen Asset Management Asia Ltd, each of which is wholly owned by Aberdeen Asset Management PLC. “Aberdeen” is a U.S. registered service mark of Aberdeen Asset Management PLC.