Upcoming Opportunities and Potential Threats for Walgreens Boots

In this part, we’ll discuss the company’s upcoming opportunities and potential threats.

Feb. 3 2016, Updated 10:04 a.m. ET

Opportunities and threats

This section is a continuation to the previous part of this series, in which we talked about Walgreens Boots Alliance’s (WBA) strengths and weaknesses. In this part, we’ll discuss the company’s upcoming opportunities and potential threats.

Opportunities

- Like the Boots Alliance merger, the Rite Aid acquisition could bring greater buying power for the company. Both deals mean better capital backing for the company, which, in the long run, would help it expand into markets that have not been already explored.

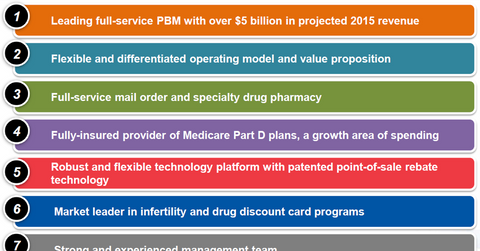

- With the Rite Aid (RAD) deal, Walgreens Boots will gain control over Envision Pharma, the pharmacy-benefit management company that Rite Aid acquired at the beginning of 2015. Pharmacy-benefit managers process prescriptions for insurance companies or corporations and use their size to negotiate better deals with drug makers and pharmacies. US competitor CVS Health merged with Caremark in 2007 and is currently one of the biggest pharmacy-benefit management companies in the United States.

Threats

- In addition to the competition from drugstore specialists, Walgreens Boots faces competition from mass merchandisers and grocers such as Walmart (WMT) and Kroger (KR). Kroger operates more than 2,000 pharmacies in the United States, while Walmart has 4,000.

- The US drugstore sector is becoming increasingly crowded, restricting opportunities for organic store openings.

ETF exposure

Walgreens Boots Alliance (WBA) has a market cap of $86.2 billion as of January 15, 2016, and is a component of the S&P 500. It has a weight of ~4.9% in the PowerShares Dynamic Retail ETF (PMR), ~1.9% in the PowerShares QQQ Trust ETF (QQQ), ~ 0.4% in the iShares Core S&P 500 ETF (IVV), and ~4.4% in the SPDR Consumer Staples Select Sector ETF (XLP).