Will the Dow Chemical and DuPont Merger Have Operational Synergy?

With corporate changes, the combined company is expected to generate total cost savings of $3 billion over the next two years after the merger.

Dec. 17 2015, Updated 1:05 p.m. ET

Cost savings of $3.0 billion

Dow Chemical (DOW) is the second-largest integrated chemical player in the world. It has a leading product portfolio of agricultural sciences, performance materials and chemicals, and performance plastics. DuPont (DD) has a leading product portfolio of agriculture and specialty products. It’s driven by its strong R&D (research and development) activities and technology. After the merger, the company is expected to eliminate 10% of the same kind of R&D activities, optimize the supply chain, use Dow’s low-cost feedstock platform, and reduce corporate costs and leveraged costs.

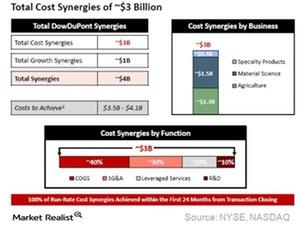

With these corporate changes, the combined company is expected to generate total cost savings of $3 billion over the next two years after the merger. DowDuPont is expected to generate total cost savings of $1.5 billion from the material science business. It’s expected to generate $1.3 billion from the agricultural operation and $0.3 billion from crop protection business. Management stated that with $3 billion of cost savings, the company could unlock value worth $30 billion for shareholders in the future considering the EV/EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple of 10x for the combined company.

In terms of the cost metrics, DowDuPont is expected to generate 40% of the total cost savings from optimizing the COGS (cost of goods sold). It’s expected to generate 30% from SG&A (selling, general & administrative) expenses and 30% from the optimum debt level and efficient research and development activities.

Growth synergies of $1 billion

After the merger, the merged entity is expected to have a stronger geographical presence. With respect to Dow and DuPont’s revenue in 2014, the combined entity would generate around 40% from the domestic market in North America. It would generate 42% from EMEA (Europe, Middle East and Africa). It would generate 18% from its increased presence in Asia and Latin America.

DowDuPont will also have access to Dow and DuPont’s clients and geographical operations. With an increased global presence and focused portfolio approach, the merged entity would have the potential to capture growth in Asia. It’s a high-growth region. It would be able to enhance its market position in Europe. With an industry-leading product portfolio and an increased client base and geographical operations, DowDuPont is expected to generate a total growth synergy of $1 billion.

During the conference call, management pointed out that the combined company is expected to realize an additional $700 million cost benefit in 2016 by reducing DuPont’s business and corporate costs. DowDuPont will also improve Dow’s productivity. It’s expected to realize the total benefit of $1 billion until 2017. Management also said that the combined company will have ~$5 billion of leveraged services with the total COGS of more than $55 billion. DowDuPont will have an additional opportunity to improve its productivity and margins. It will have a competitive edge over Syngenta (SYT).

Investors can invest in chemical ETFs like the Materials Select Sector SPDR (XLB) and the iShares U.S. Basic Materials ETF (IYM) to get exposure to the chemical industry. These two ETFs track the chemical companies’ performance. Dow Chemical has the highest holdings in XLB. DuPont has the highest holdings in IYM.