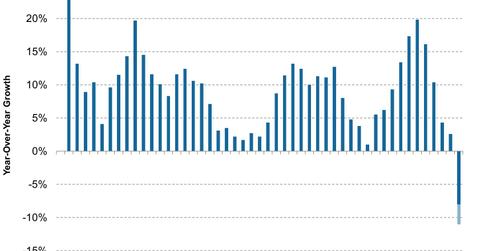

Chipotle May Report First Negative Same-Store Sales Growth in 4Q15

Chipotle expects its 4Q15 same-store sales growth to range from -8% to -11%. This would be the first time in almost ten years the company expects to report negative same-store sales growth.

Dec. 23 2015, Updated 5:06 p.m. ET

Impacting growth

Previously in this series, we discussed the health concerns stemming from October’s E. coli outbreak and its impact on Chipotle Mexican Grill (CMG). Here, we will look at a measure that investors should consider following when investing in restaurant stocks: same-store sales growth.

Following public health issues such as an E. coli outbreak, which can cause serious illness or can be fatal, a restaurant company naturally faces a slowdown in customer visits until the outbreak is declared to be over.

Negative same-store sales growth

The severity of the negative impact of the E. coli outbreak on Chipotle is summed up by the above chart. The company’s management expects its 4Q15 same-store sales growth to be in the range of -8% to -11%. This would be the first time in almost ten years that the company is expected to report negative same-store sales growth.

You may consider a more diversified portfolio such as the Consumer Discretionary Select Sector SPDR ETF (XLY). Currently, Chipotle Mexican Grill (CMG) forms 1% of XLY’s total portfolio. XLY also holds 4% of McDonald’s (MCD), 1.5% of Yum! Brands (YUM), and 3% of Starbucks (SBUX) as a percentage of its total portfolio.

How could Chipotle be impacted?

Unfortunately, concerns related to food safety do not dissipate in a single quarter, as a negative perception could linger. We saw this in the case of Yum! Brands (YUM), which experienced a food safety concern in China in 2012 and 2014.

Also, bear in mind that positive same-store sales growth does not mean that such an issue is over for a company. We will explore this further in the next part of this series.