It’s Beginning to Look a Lot like a US Steel Consumption Cool Down

If the Fed continues to raise rates in 2016, we could see the impact on the housing and automotive sectors, which would only add to steel’s woes.

Dec. 18 2015, Updated 8:06 a.m. ET

US steel consumption

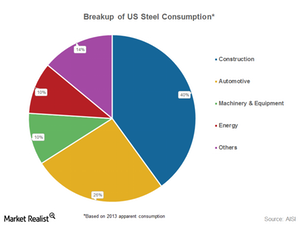

Steel serves as a raw material for various industries. You and I don’t consume the crude steel that’s produced in factories directly. The construction and transportation sector, including both automobiles and railways, consumes most steel worldwide.

Cumulatively, these two sectors consume two-thirds of all US steel consumption, based on the 2013 apparent steel demand, as can be seen in the graph above. Other sectors that are major consumers of steel include energy, home appliances, machinery, and defense.

The housing sector

The Federal Reserve highlighted the recovery in the housing sector while announcing the rate hike this December. Housing demand has indeed been quite strong for quite some time. Automobile sales have also been booming with the fiscal 2015 car sales expected to top 18 million mark.

For the beleaguered steel industry, strong demand from construction and automotive sectors have been the only saving grace. Nucor Corporation (NUE) and Commercial Metals Company (CMC) are the leading steel suppliers to the construction industry. Currently, Nucor makes up 2.6% of the Materials Select Sector SPDR ETF (XLB).

Other sectors, especially the energy sector, have seen severe demand slowdowns in 2015. U.S. Steel Corporation (X) and Tenaris SA (TS), which supply steel products to the energy sector, have seen their shipments fall off the cliff during the past couple of quarters.

Gauging the impact of the rate hike

One of the factors driving higher car and home sales has been lower mortgage rates. Now, with the Federal Reserve embarking on a tightening path, the housing and automotive sectors could see some repercussions.

To be sure, it is not going to be an overnight impact. However, if the Federal Reserve continues to raise rates in 2016 as well, we could see the impact on the housing and automotive sectors. And this much is clear: any slowdown in the construction and automotive sectors would only add to the steel industry’s woes.

You can also read Market Realist’s “US Steel Industry’s Woes Are Far from Over” to find out what’s driving steel stocks to multiyear lows.