How Does LyondellBasell’s Geographical Exposure Compare to Peers?

LyondellBasell (LYB) has a presence throughout the world. However, the company generates around 50% of its revenue from the United States.

Dec. 2 2015, Updated 10:06 a.m. ET

LYB’s geographical sales exposure

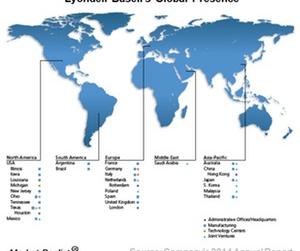

LyondellBasell (LYB) has a presence throughout the world. However, the company generates around 50% of its revenue from the United States. In 2014, LYB generated 51.7% of its revenue from the US, followed by Europe with more than 25%. The rest of its revenue came from other regions. LYB’s regional revenue exposure has almost been constant over the last three years. LYB’s revenues are less sensitive to exchange rates, as it generated only 48% of sales from the international market.

Manufacturing facilities

Most of LYB’s manufacturing facilities are located in the US and Europe. The company generates around 80% of its total revenue from these two regions. Apart from the US and Europe, the company has manufacturing facilities in South America (Argentina and Brazil) and Asia-Pacific (Australia, China, Japan, and Thailand). However, the company has an ownership interest in many joint ventures in many countries including South Korea, Malaysia, China, Saudi Arabia, and Mexico.

Peers’ geographic exposure

Dow Chemical (DOW) generated 37% of its revenue from North America, followed by 34% from the Europe, Middle East, Africa, and India (or EMEAI) region, and the remaining 29% from Asia-Pacific and Latin America. Another major peer DuPont (DD) has high international revenue exposure of 60%. Therefore, DD and Dow’s earnings are more sensitive to currency fluctuation than LYB’s earnings. On the other hand, Monsanto (MON) has a similar international exposure to LYB. Monsanto generated 54% of its 2014 revenue from the US and the rest from international markets.

The iShares U.S. Basic Materials ETF (IYM) and the Materials Select Sector SPDR (XLB) invest majorly in the North American chemical players. The combined holdings of DD, MON, and LYB is 26% in the Materials Select Sector SPDR (XLB) ETF.