Why TJX Companies Might Post Tepid Earnings Growth in 2Q16

TJX Companies (TJX) will announce its results for the second quarter of fiscal 2016 on August 18. The second quarter ended on August 1, 2015.

Dec. 4 2020, Updated 10:53 a.m. ET

Second quarter results

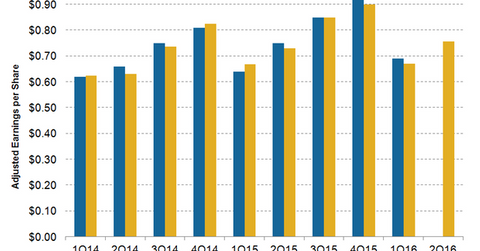

TJX Companies (TJX) will announce its results for the second quarter of fiscal 2016 on August 18. The second quarter ended on August 1, 2015. The consensus Wall Street analyst estimate for 2Q16’s adjusted earnings per share (or EPS) is $0.76.

Performance in the previous quarter

The adjusted EPS for TJX Companies in 1Q16, which ended May 2, 2015, increased by 7.8% to $0.69 compared to the corresponding quarter of the previous year. The company exceeded the consensus analyst earnings estimate of $0.67. TJX Companies’ earnings in 1Q16 were primarily driven by higher sales.

Ross Stores’ (ROST) adjusted EPS increased by 19.1% to $0.69, helped by higher sales and strong expense control. Nordstrom (JWN), which has been aggressively expanding in the off-price space through its Rack stores, reported an 8.3% decline in its adjusted EPS of $0.66 in the comparable first quarter. This decline was a result of the company’s growth investments.

TJX Companies, Ross Stores, and Nordstrom together constitute 3.3% of the portfolio holdings in the SPDR S&P Retail ETF (XRT) and 0.7% in the iShares Russell 1000 Growth ETF (IWF).

What might affect 2Q16 earnings?

TJX Companies expects its 2Q16 EPS in the $0.72-to-$0.74 range, compared to $0.73 in the comparable quarter of the previous fiscal year. Based on the adjusted EPS of $0.75 in 2Q15, the company anticipates EPS to decline by 1% to 4% in 2Q16. The adjusted EPS in the second quarter of the previous year excluded a debt extinguishment charge of $16.8 million. TJX Companies’ earnings growth guidance for 2Q16 takes into account a 9% expected combined impact of currency headwinds, investment in associates, increased investments, and higher pension costs.

TJX Companies is one of the leading off-price retailers with a presence in the United States, Canada, and Europe. Our TJX Companies overview series provides more information on the company’s business.

The next article of this series discusses sales expectations for TJX Companies in 2Q16.