What’s the Rationale for the Broadcom-Avago Merger?

The Broadcom-Avago merger is expected to deliver $750 million in annual synergies within about 18 months of completion of the deal.

June 4 2015, Updated 11:07 a.m. ET

Consolidation in the semiconductor space

The Broadcom-Avago merger is one of many in the semiconductor space lately, and M&A (merger and acquisition) activity is heating up. The day after Broadcom (BRCM) and Avago Technologies (AVGO) announced their merger, Altera (ALTR) and Intel (INTC) agreed to merge.

Companies are having to achieve greater scale to compete on a cost basis. Avago has been a very acquisitive buyer in the semiconductor space and is going along with the growth by acquisition strategy. Given Avago’s Singaporean domicile, it has a very tax-advantaged acquisition vehicle and pays something like 5% in corporate taxes to the Singaporean government.

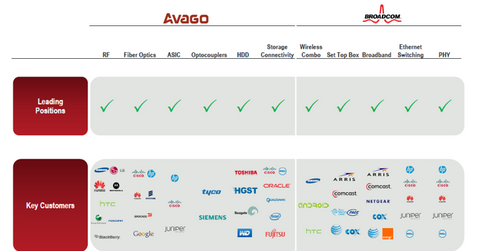

Two companies have complementary portfolio of products

As we heard on the conference call, Avago and Broadcom have a very complementary portfolio. This means they offer products that don’t compete with each other but would probably appeal to the same customers. These sorts of deals are often driven by the potential for revenue synergies where the combined company hopes to leverage an existing relation with a customer in order to earn another part of the business. Their big customers include Cisco Systems (CSCO), Juniper Networks (JNPR), and Hewlett-Packard (HPQ), among others.

Synergies

The Broadcom-Avago merger is expected to deliver $750 million in annual synergies within about 18 months of completion of the deal. These synergies are 100% cost synergies in which overlapping administrative duties are eliminated.

Avago has aggressive goals for the combined company, specifically to get operating margins from Avago’s current 38% and to get Broadcom’s 24% to 40% by 2019. While the companies don’t specifically spell out the potential revenue synergies, they do acknowledge there will be opportunities to cross-sell their biggest customers.