Mutual Funds Own 18% of Berkshire Hathaway

Major mutual funds prefer Berkshire Hathaway (BRK-B) over private equity firms and asset managers like Blackstone (BX) and BlackRock (BLK).

April 10 2015, Published 10:29 a.m. ET

Berkshire’s growth

Berkshire Hathaway (BRK-B) hasn’t paid out dividends in its fifty-year history. The company believes that it can do a better job at managing funds than investors can do for themselves. As a result, the only metric for gauging its performance is the growth in its share price and its intrinsic value.

Mutual funds are actively managed funds and as such, alter portfolios based on expectations of earnings and equity growth. Mutual funds have long held interests in Berkshire, expanding their holdings over the decades. Mutual funds built around sectoral, growth, large-cap, and financial themes have invested in Berkshire. Currently, mutual funds own about 18% of Berkshire B Class equity.

Mutual funds build stakes

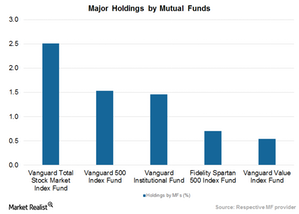

Major mutual funds with stakes in Berkshire include the Vanguard Total Stock Market Equity Fund, the Vanguard 500 Index Fund, the Vanguard Institutional Index Fund, the Fidelity Spartan 500 Index Fund, the Vanguard Value Index Fund, the CREF Stock Account, the New York State Teachers Retirement Fund, John Hancock Funds III Disciplined Value Fund, and the T. Rowe Price Equity Index 500 Fund.

Major mutual funds prefer Berkshire Hathaway (BRK-B) over private equity firms and asset managers like Blackstone (BX), BlackRock (BLK), Goldman Sachs (GS), and Morgan Stanley (MS).

Together these companies make up 5.93% of the Financial Select Sector SPDR Fund (XLF).

Berkshire Hathaway also competes with insurance giants including Allianz (ALV), American International Group (AIG), Metlife (MET), and other major players from the energy, industrial, and infrastructure sectors that form part of the iShares S&P 500 (IVV).