Steel prices hit rock bottom, the lowest level since 2009

Steel prices crashed by almost two-thirds at the peak of the global financial crisis in 2009. Last year, they dropped by 10%.

March 20 2015, Updated 6:50 p.m. ET

Steel prices fall

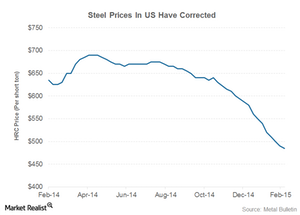

Steel prices are a key driver for steel companies. Steel prices crashed by almost two-thirds at the peak of the global financial crisis in 2009. Last year, steel prices dropped by ~10%. Most of this came in the latter half of the year. Prices of all base metals have corrected in tandem with the fall in crude oil prices.

Prices correct sharply

The above chart shows the prices of hot rolled coil (or HRC) in the United States. As you can see, prices have corrected by almost 20% so far in 2015. These are prevailing spot prices for HRC. This is the lowest HRC price since mid-2009.

There are several grades of steel products that steel companies offer. However, the movement in HRC prices generally impacts the prices of other grades of steel. According to the analysts, steel companies such as Nucor (NUE) and Steel Dynamics (STLD) have reduced steel prices for their customers. The fall in steel prices is negative for all steel companies.

Value-added products

Value-added steel products sell at higher prices compared to standard grade steel products. AK Steel (AKS) has one of the highest average selling prices among steel companies. It gets a large portion of its revenues from value-added steel products. U.S. Steel Corporation (X) also recently increased the share of value-added steel products in its portfolio. Currently, U.S. Steel forms 2.86% of the SPDR S&P Metals and Mining ETF (XME).

Steel prices are also impacted by the prices of major steelmaking raw materials. Iron ore and steel scrap are among the major raw materials for producing steel. In the next part, we’ll see the latest trends in iron ore prices.