Blackstone’s Dominant Performance in Private Equity Space

Blackstone (BX) generated revenues of $2.7 billion and economic income of $1.8 billion for the year, backed by strong performance of BCP V and BCP VI.

March 27 2015, Updated 2:05 p.m. ET

Main pillar of growth

The Blackstone Group L.P. (BX) operates its funds under the partnership structure. The limited partners subscribe to funds by committing capital. Blackstone’s private equity segment includes corporate, private equity funds, tactical opportunities, business, and private fund of funds.

The company has raised six general private equity funds and two specialized funds that focus on energy- and communications-related investments. Together, these businesses are called the Blackstone Capital Partners (or BCP) funds.

Riding on performance

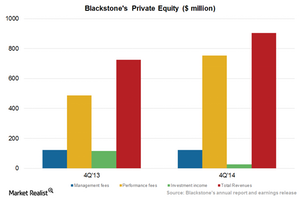

Blackstone (BX) has generated total revenues of $2.7 billion and economic income of $1.8 billion for the full year. These results are backed mainly by a strong performance of the BCP V fund, which generated a 27% return, and the BCP VI fund, which generated 21.9% for the full year.

The company’s performance fees increased by 172% in 2014 compared to the previous year. Blackstone continues its focus on operations of its portfolio companies.

BCP V alone generated $834 million in performance fees of the total of $1.98 billion in the fourth quarter.

The company is also focused on its realization activity. The last quarter generated $4.2 billion, driven by public and strategic exits in the corporate private equity funds. Major exists for the quarter include the following:

- United Biscuits

- secondary sales of Pinnacle, Hilton, Merlin, Nielsen, and Kosmos

Blackstone’s private equity segment has performed better than its peers in the alternative management space. Its peers include the Carlyle Group (CG), KKR & Co. L.P. (KKR), Apollo Global Management (APO), and T. Rowe Price (TROW). Its peers also include other major players that form part of the Financial Select Sector SPDR Fund (XLF) and the iShares U.S. Financials ETF (IYF).