Analyzing Walmart’s Profitability And Margins Versus Peers

Despite its sales growth, the gross profit rate declined for Walmart’s US operations, consisting of the Walmart US and Sam’s Club segments.

March 16 2015, Updated 1:05 p.m. ET

Walmart’s profitability declines

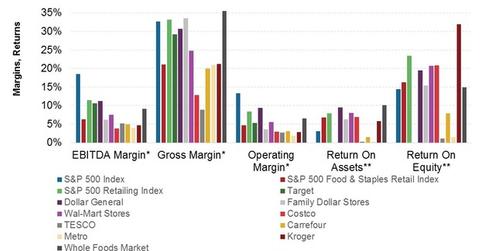

During fiscal 2015, Walmart’s (WMT) gross margin declined marginally to 24.3%. Despite its sales growth, the gross profit rate declined for Walmart’s US operations, consisting of the Walmart US and Sam’s Club segments. The decline stemmed from the company’s initiatives on its meat products and prescription plans for Medicare. The rollout of the Plus Cash Rewards program and a slightly unfavorable merchandise mix also impacted results.

Overall operating margins also declined slightly to 5.6%, falling for the two US-based segments. Higher healthcare and utility costs were primarily responsible for this dip.

Peer group comparison

Peers Target (TGT) and Dollar Tree (DLTR) also reported declining gross margins in the fiscal year ending January 31, 2015. However, Kroger (KR) reported an increase in margins for the tenth straight year. A higher margin on fuel sales and improved operating performance helped Kroger’s profitability. KR also reported its 45th straight quarter of same-store sales growth, excluding fuel.

Kroger’s (KR) produce and expanding organic foods assortment is rated one of the best in the industry. Organic produce generally earns higher margins. Target (TGT) is also looking to shore up available food and produce, as supermarket retailers are experiencing sales traction on the back of an improving labor market and wage gains. We’ll explore that further in Part 13. Organic supermarket chain Whole Foods Market (WFM) has the highest gross margin rate among its peers, as shown in the chart above.

As of March 2, 2015, Kroger (KR) and Walmart (WMT) together constitute ~9.3% of the portfolio holdings of the SPDR Consumer Staples Select Sector ETF (XLP).

International performance improves

In comparison to its domestic performance, Walmart’s gross profit rate was up in four of its five largest international markets on a constant currency basis: China, Brazil, UK, and Mexico. A larger ticket size and investments in price and costs were primarily responsible, as were higher e-commerce sales. Operating profit margins for Walmart International were also higher, at 4% in fiscal 2014, rising to 4.5% in fiscal 2015.