Overview: AQR Capital Management positions in 1Q14

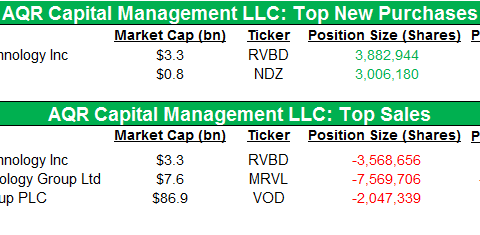

AQR Capital opened new positions in the quarter—the notable ones being Riverbed Technology Inc. (RVBD) and Nordion Inc. (NDZ).

Oct. 30 2019, Updated 10:00 a.m. ET

AQR Capital Management

AQR Capital Management is an investment management firm founded in 1998 by former Goldman Sachs portfolio manager Clifford Asness along with partners David Kabiller, John Liew, and Robert Krail. In the first quarter, the fund’s $33 billion U.S. long portfolio comprised 2,441 stocks.

AQR Capital opened new positions in the quarter—the notable ones being Riverbed Technology Inc. (RVBD) and Nordion Inc. (NDZ). It sold off positions in LyondellBasell Industries (LYB), Marvell Technology Group (MRVL), and Vodafone (VOD).

The fund’s notable position increases during the quarter were Beam (BEAM), which was taken over by Suntory, Forest Laboratories (FRX), and Time Warner Cable (TWC), both of which are in the midst of being taken over by Actavis and Comcast, respectively. AQR’s top tem holdings for the first quarter are outlined below.

According to AQR Capital Management’s website, it has over $105 billion in assets under management (as of April 1, 2014) for institutional investors, including pensions, insurance companies, endowments, foundations, and sovereign wealth funds, as well as registered investment advisers. The company is based in Greenwich, Connecticut.