Analyzing Key Drivers for Infosys in Fiscal 2018

Infosys expects its total revenues in fiscal 2018 to expand 6.5%–7.5%.

April 3 2018, Updated 7:30 a.m. ET

Key revenue drivers

Higher global IT spending has helped Infosys (INFY) maintain strong growth in its overall revenue in the past few quarters. This spending is driven by the improving global economic scenario and the ongoing digital transformation trend. Huge contract wins, strong deal pipelines, and new service launches act as strong catalysts for revenue growth.

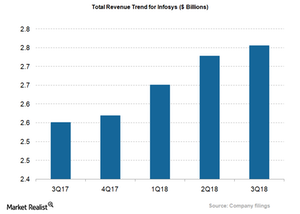

From the graph above, we can see Infosys’s top-line growth in the last five quarters, maintaining an increasing trend. During this period, Infosys’s top line has climbed at a CAGR (compound annual growth rate) of 1.9%.

In fiscal 3Q18, the company’s total revenues increased 8.0% YoY to $2.8 billion. However, on a constant currency basis, its top line gained 5.8% YoY in fiscal 3Q18. At the end of the first nine months of fiscal 2018, its revenues came in at $8.1 billion against $7.6 billion in the same period in fiscal 2017.

Analyst estimates and guidance

Of 15 analysts covering Infosys stock, one gave a “strong buy” recommendation, one gave a “buy” recommendation, 12 analysts gave “hold” recommendations, and one analyst offered a “sell” rating. The average net revenue estimate provided by these analysts for fiscal 4Q18 is ~$2.8 billion, and the average net revenue estimate for fiscal 2018 is ~$10.9 billion.

Infosys expects its total revenues in fiscal 2018 to expand 6.5%–7.5%. On a constant currency basis, its revenues are expected to grow 5.5%–6.5%.

IT heavyweights Microsoft (MSFT) and International Business Machines (IBM) reported their earnings in January 2018. On a constant currency basis, Microsoft’s fiscal 2Q18 revenues grew 11.0% YoY, and IBM’s 4Q17 revenues improved 1.0% YoY.