Why mega fast food companies depend on macro trends

Why macro trends are important The two major factors that drive a company’s performance are industry-related and company-specific catalysts. For ETFs that invest in a diversified number of companies, the effect of company-specific catalysts on the overall ETF”s performance is limited. So macro or industry factors tend to be the major factor driving performances. Industry […]

Sept. 19 2013, Published 3:26 p.m. ET

Why macro trends are important

The two major factors that drive a company’s performance are industry-related and company-specific catalysts. For ETFs that invest in a diversified number of companies, the effect of company-specific catalysts on the overall ETF”s performance is limited. So macro or industry factors tend to be the major factor driving performances.

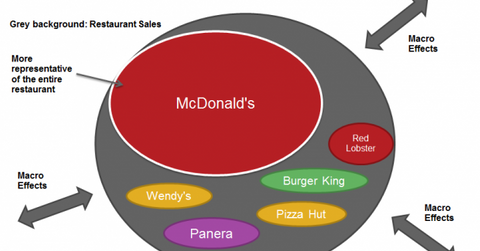

Industry market share and macro trends

Plus, mega-companies often represent how the entire industry is doing because of their large market share and size. The industry, in turn, reflects closely with the fundamentals of these large fast-food chains like McDonald’s and Yum Brands. So macro indicators are a great place for investors to gain a picture of how these restaurant giants may perform.

Top-down versus bottom-up analysis

For these companies, a top-down approach may be more useful than a bottom-up approach. In the top-down approach, investors begin by analyzing the macro condition and then dive into which company is best positioned to take advantage. In the bottom-up approach, investors analyze what makes the company special, place less emphasis on the overall macro picture, and decide whether to invest.

A top-down approach is more useful for mega companies that represent the entire industry because their performances largely depend on how the entire industry is doing—as long as competition doesn’t heat up. This contrasts with smaller companies that less represent the entire industry, and have room to be largely eaten away by competition or take market share, which will separately drive performance. Wendy’s (WEN) historic performance, which was just striding along until recently, and Popeye’s, owned by AFC Enterprises Inc. (AFCE), are two examples.