Why mortgage servicing rights imply risks for servicers

Risks of being a servicer Generally, servicing seems like an easy job. Collect the payment, give the government its take, pass the (smaller) payment to the bondholders, and keep the rest. What could go wrong? There’s just one catch. What happens if you miss your mortgage payment? The U.S. government guarantees Ginnie Mae securities. When […]

Nov. 20 2020, Updated 10:53 a.m. ET

Risks of being a servicer

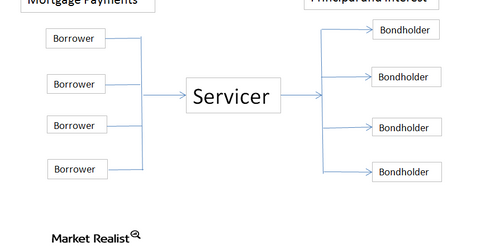

Generally, servicing seems like an easy job. Collect the payment, give the government its take, pass the (smaller) payment to the bondholders, and keep the rest. What could go wrong?

There’s just one catch. What happens if you miss your mortgage payment? The U.S. government guarantees Ginnie Mae securities. When you buy a Ginnie Mae security, you’ll receive any principal and interest you’re owed. Period. So even if the ultimate borrower defaults on its mortgage, you will still get your money—on time, every month.

It’s up to the servicer to advance the payment to the bondholders. So even if you as a borrower stop paying your bills, the servicer is on the hook for the payment to the bondholders. And if you don’t make your payment, the servicer has to reach into its own pocket to make up the difference. Historically, servicers could borrow money to do this (through an advancement line), but that option is no longer available. So now, the servicer has to come up with the money and pay the bondholders while initiating foreclosure proceedings. Once the house is foreclosed upon, the servicer will submit a bill to the Federal Housing Agency (FHA) to get back everything it advanced. These advances piled up after the housing crisis, and some private label servicers ended up insolvent.

As a result of the advances, Basel III (the Third Basel Accord) instituted painful capital requirements for mortgage servicing rights. Now, if a bank holds MSRs, the bank must reserve additional capital in case MSRs become too large a percent of its capital. This requirement has depressed MSR values, as banks have sold off their portfolios. Historically, MSRs have traded at five to seven times annual cash flow. Now, however, they are trading at two to three times.