China’s wage inflation: Bad news for corporate profits and banks

Wage inflation in Chinese manufacturing With an appreciating currency and growing economy, Chinese manufacturers have experienced wage inflation. The cost of Chinese labor is simply becoming more expensive, as the below graph indicates. Private sector wage growth in China was 14% in 2012, while GDP growth is slowing to around 7.5% per annum. Wages are […]

Nov. 20 2020, Updated 5:21 p.m. ET

Wage inflation in Chinese manufacturing

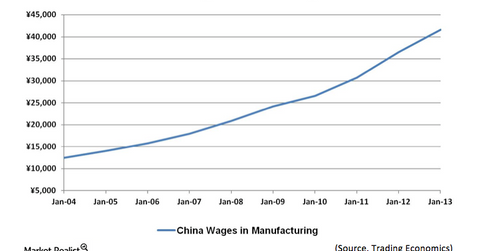

With an appreciating currency and growing economy, Chinese manufacturers have experienced wage inflation. The cost of Chinese labor is simply becoming more expensive, as the below graph indicates. Private sector wage growth in China was 14% in 2012, while GDP growth is slowing to around 7.5% per annum. Wages are simply growing much faster than the overall economy, which fuels inflation and real estate bubbles when banks are willing lenders, as is apparently the case in China. As a result of the growth in the cost base of Chinese production, cost sensitive manufacturers, such a clothing and textile manufacturers, have begun to look to countries such as Vietnam to contain production costs.

As wage costs have grown faster than the broader economy, profit margins in China have come under pressure. Recent weakness in Chinese equity markets have reflected investors’ concerns that Chinese companies may face shrinking profit margins in the future, and that the banking system in China may also experience increased pressure. As corporate earnings margins come under pressure, corporations may have less cash flow to service their debt. Chinese firms must increase productivity to maintain margins through increased technological investment, cut manufacturing costs such as labor, and/or grow sales. These cost pressures are likely to put increased pressure on the profit margins of Chinese exports, and temper historical export growth rates.

Given soft economic conditions in the USA and EU, growing sales is not as easy as it used to be. Additionally, should the dollar continue to appreciate, China’s Yuan peg to the US Dollar could also mean an associated increased in cost for Chinese exports vis-à-vis other currencies. Meanwhile, the free floating Japanese yen may continue to depreciate against the US dollar, providing pricing support to Japanese manufacturers relative to Chinese manufacturers. Although China’s export machine focuses on the lower end of labor-intensive manufacturing relative to Japan, an ongoing trend in the growth of China’s cost base could at least temper China’s plans to expand its manufacturing base into increasingly capital intensive technologies such as autos, aircraft or aerospace.

China Maxing Out on Debt

As China migrates to a single digit growth rate economy with higher wages, attention is now turning to the banking sector’s ability to manage ballooning debt. One study by CLSA analyst Francis Cheung notes that total Chinese debt has doubled in the last four years, and could rise from around 198% of GDP by then end of 2012 to 245% of GDP by 2015. The Fitch Ratings agency has signaled a warning on the growth rate of Chinese debt. Gordon Chang notes in Forbes that the days of credit fueled growth may be facing a dramatic slowdown, as every dollar in credit growth in 2007 was associated with 87 cents of growth, whereas currently every dollar of credit growth is associated with a paltry 17 cents of growth. Given this dramatic deceleration of the multiplier effect associated with debt growth, it would appear that a very significant near-term deceleration of economic growth is underway in China.

Outlook

Meanwhile, a weakening yen and relatively flat wage growth in Japan has supported Japanese markets, as reflected in Wisdom Tree Japan Hedged (DXJ) and the iShares MSCI Japan (EWJ) ETF’s. Aggressive monetary policy in the USA has supported the S&P 500 as reflected in the State Street Global Advisors S&P 500 SDPR (SPY), State Street Global Advisors Dow Jones SPDR (DIA), and Blackrock iShares S&P 500 Index (IVV), which have been up nearly 17% over the past year. Given China’s current financial challenges, both the US equity markets, and the Abenomics-driven Japanese equity markets, may continue to outpace China’s iShares FTSE China 25 Index Fund (FXI) and Korea’s iShares MSCI South Korea Capped Index Fund (EWY).

RELATED ARTICLES BY COUNTRY

-

JAPAN: For further analysis on how current policies in JAPAN, under “Abenomics” are impacting CHINA, please see JAPAN SERIES, “Why Japanese Exports Could Break Out of a 5-Year Slump.”

-

USA: For further analysis of how Consumption trends in the USA could impact CHINA’s economic growth, please see USA SERIES, “US Consumer Spending–Sustaining the Unsustainable.”