Westpac Banking Corp

Latest Westpac Banking Corp News and Updates

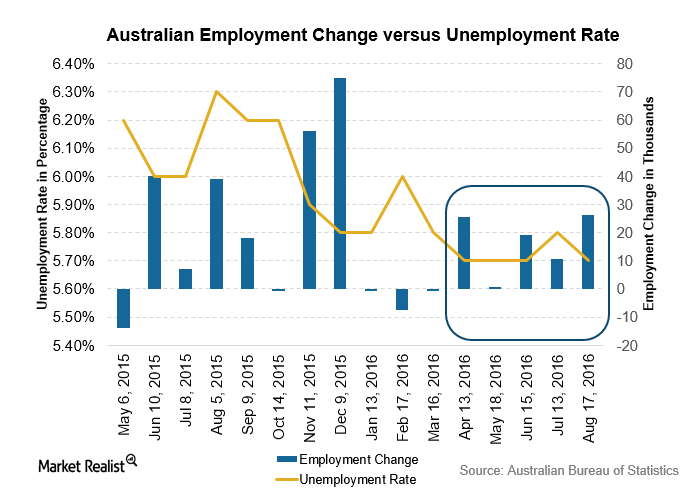

Australian Unemployment Fell: Is More Easing Needed?

The Australian Bureau of Statistics published the employment report for July on August 18, 2016. The unemployment rate fell by 0.1% to 5.7%.

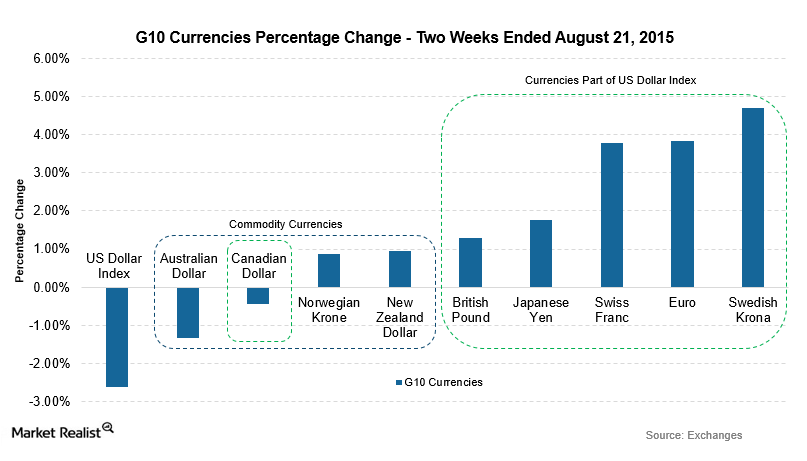

G10 Currencies Gain as US Dollar Index Sinks

The G10 currencies were impacted positively as the US dollar index dropped in value in the two weeks ending August 21, 2015.