Stanley Black & Decker Inc

Latest Stanley Black & Decker Inc News and Updates

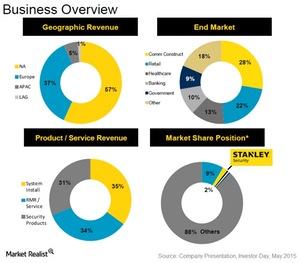

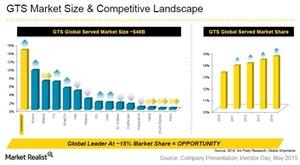

What You Should Know about Stanley Security’s Business Mix

The Stanley Security business saw a steady decline in the last four years with sales falling from $2.4 billion in 2012 to ~$2.1 billion in 2015.

What’s Stanley Black & Decker’s Market Position?

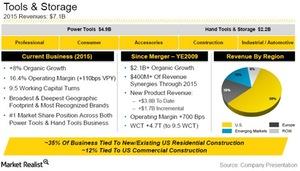

Stanley Black & Decker (SWK) has a stupendous record of launching at least 1,000 products every year at an average of three products a day.

What Are Stanley Black & Decker’s Business Segments?

Stanley Black & Decker (SWK) markets its products through three business segments: Global Tools & Storage, Security, and Industrials.

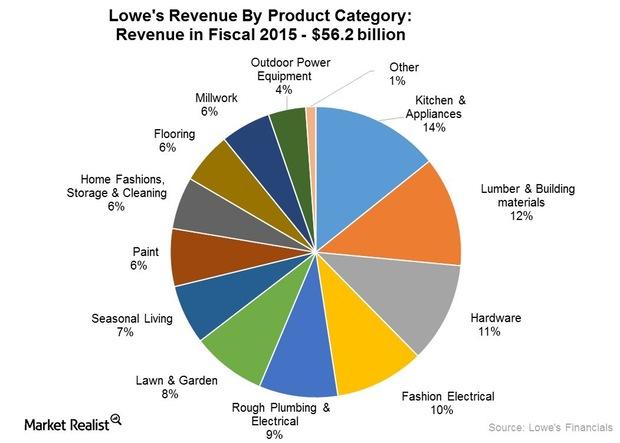

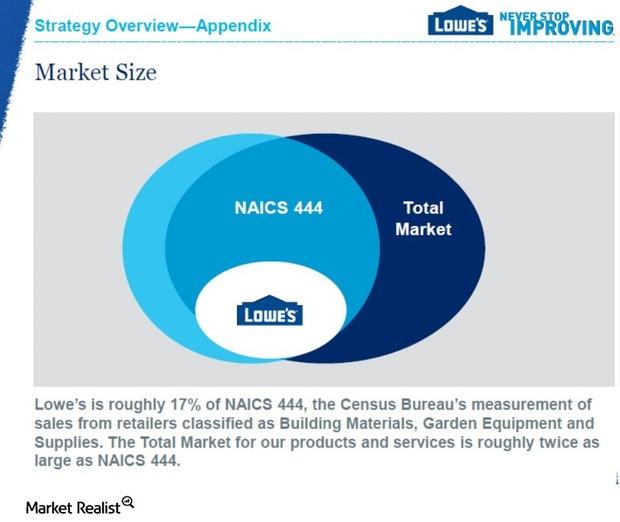

The Lowe’s-Rona Transaction: Sizing Up the Potential Synergies

Lowe’s (LOW) expects the Rona (RON.TO) transaction to be accretive to its earnings per share or EPS from the very first year after the acquisition.

Porter’s 5 Forces: Lowe’s Position in a Competitive Industry

Lowe’s (LOW) operates in the home improvement industry where most products, especially building materials, are largely standardized and undifferentiated.

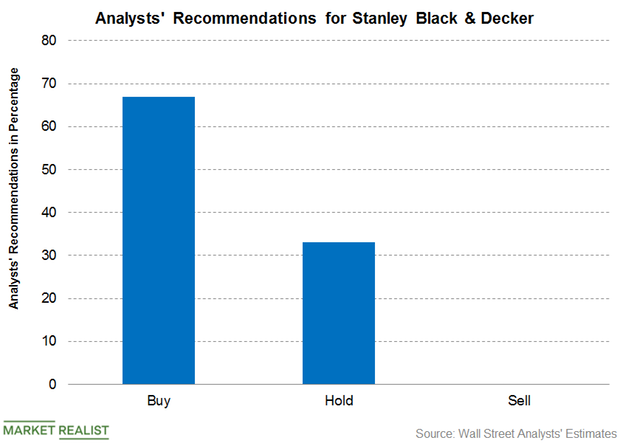

Stanley Black & Decker: Analysts’ Recommendations

Currently, 21 analysts are actively tracking Stanley Black & Decker. Among the analysts, 67% recommend a “buy,” while 33% recommend a “hold.”

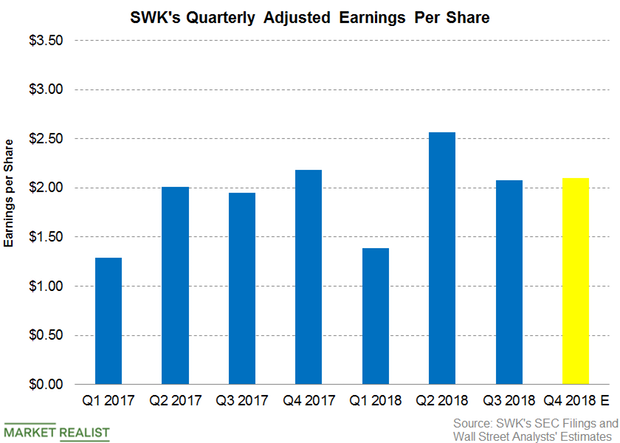

Can Stanley Black & Decker’s Q4 Earnings Beat the Estimates?

Stanley Black & Decker (SWK) is expected to post an adjusted EPS of $2.1 in the fourth quarter—a decrease of ~4.7% YoY (year-over-year).

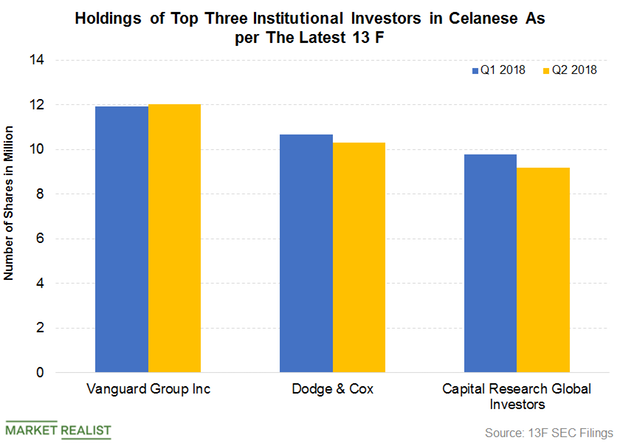

What Are Institutional Investors’ Positions on Celanese?

Second-quarter 13F SEC filings indicate that institutional investors own 95.3% of Celanese’s (CE) outstanding shares.

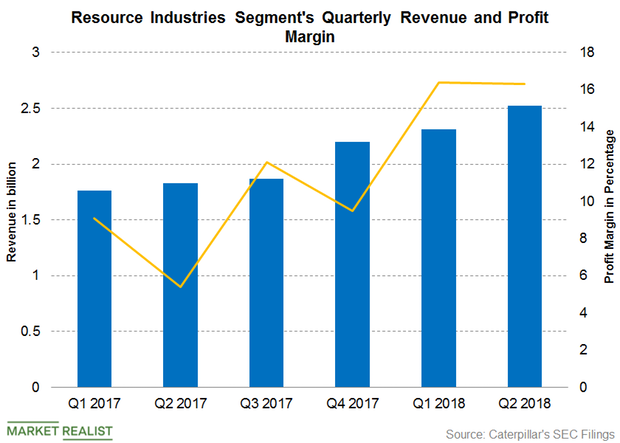

Analyzing Caterpillar’s Resource Industries Segment

Caterpillar’s Resource Industries segment is the company’s lowest revenue contributor. The segment had a revenue share of 18% in the second quarter.

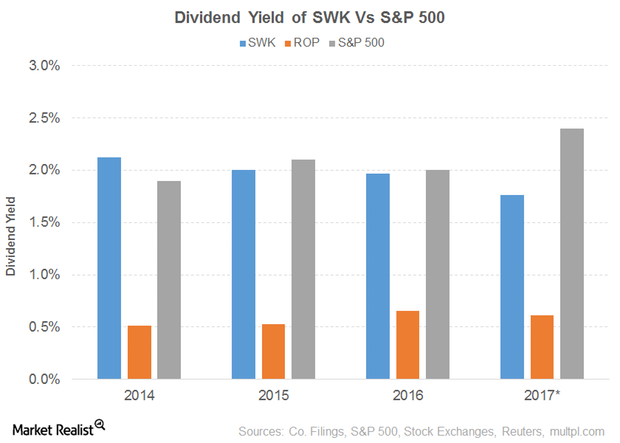

Dividend Yield of Stanley Black & Decker

Stanley Black & Decker’s (SWK) PE ratio of 21.1x is pitted against a sector average of 29.3x. The dividend yield of 1.8% is pitted against a sector average of 1.6%.

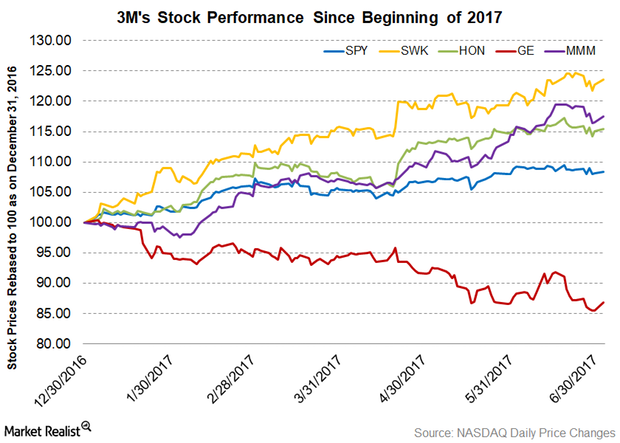

How Does 3M Company Compare to Its Industrial Peers?

Among 3M Company’s (MMM) industrial peers, MMM stock has been the second-best performer since the beginning of 2017.

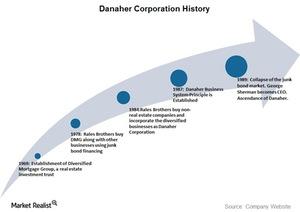

Danaher’s Journey from Corporate Raider to Corporate Statesman

Danaher (DHR) was the brainchild of brothers Steven and Mitchell Rales. It was incorporated as a holding company in 1984.

Has Lincoln Electric Outperformed Its Peers?

For fiscal 2015, Lincoln Electric (LECO) successfully gave back $486 million to its shareholders.

How Stanley Works and Black & Decker Got Their Starts

Black & Decker was eventually merged with Stanley Works in 2010 to form the Stanley Black & Decker company (SWK).

How Stanley Black & Decker Came to Be

Stanley Black & Decker (SWK), a Fortune 500 company, is the world’s leading tool company. It provides a wide array of products to the construction (XHB) and automobile (FSAVX) end markets.