Guggenheim S&P 500® Pure Value ETF

Latest Guggenheim S&P 500® Pure Value ETF News and Updates

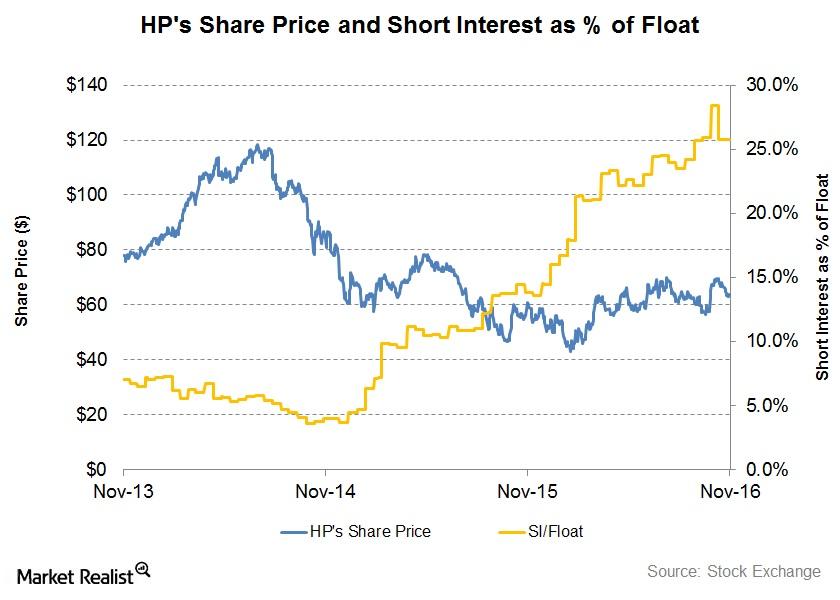

Has Helmerich & Payne’s Short Interest Decreased since Fiscal 3Q16?

Helmerich & Payne’s (HP) short interest as a percentage of its float was 25.7% on November 2, compared to 24.5% on June 30. Since the end of fiscal 3Q16, HP’s short interest has increased 5%.

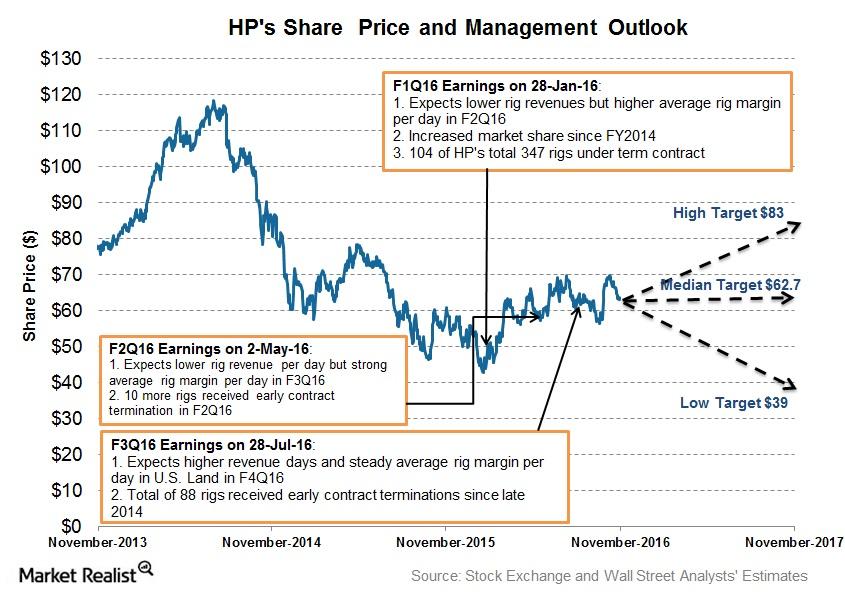

What Are Helmerich & Payne’s Management Estimates for Fiscal 4Q16?

In the US Land segment, Helmerich & Payne (HP) expects revenue days to see a 3% increase to 7% during fiscal 4Q16 compared to fiscal 3Q16.