Principal Financial Group

Latest Principal Financial Group News and Updates

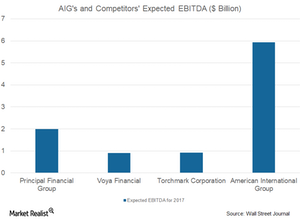

What Could Drive AIG’s Performance in the Future?

According to Brian Duperreault, chief executive officer of American International Group (AIG), a company in any industry has to take the digitization path for long-term growth and success.

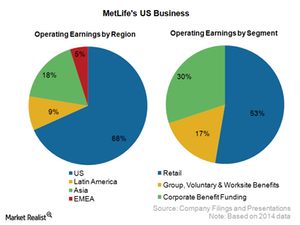

MetLife is a leading player in the US insurance industry

MetLife intends to grow its retail business and expects low single-digit growth in the long term.

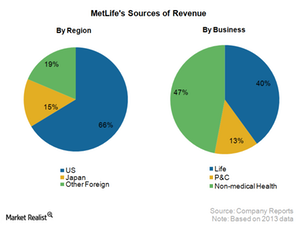

MetLife – A globally diversified insurance company

MetLife is a market leader in the US and the largest life insurer in Mexico and Chile. It is among the leading players in Japan, Korea, and Poland.