Mid-America Apartment Communities

Latest Mid-America Apartment Communities News and Updates

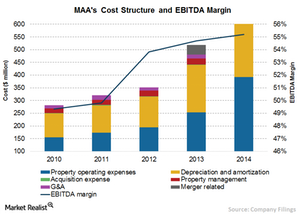

MAA’s EBITDA Margin: Lower than Industry Average

MAA’s EBITDA margin is lower than the industry average of 57.7%, as well as the margins reported by some of the company’s peers.

Investing in Equity Residential: A Company Overview

Equity Residential was formed as a REIT. It became a publicly traded company in 1993. It’s part of the S&P 500 Index. It employs about 3,500 people.