Luxottica Group SpA

Latest Luxottica Group SpA News and Updates

Company & Industry Overviews Which Investments Have Hurt the Harbor Capital Appreciation Fund the Most in 2016?

The Harbor Capital Appreciation Fund Investor Class has tanked by 3.5% YTD in 2016, making it the second-worst performer YTD among our 12 funds.

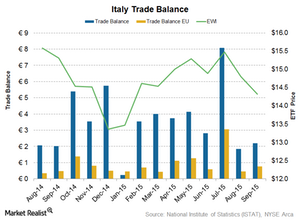

Italy’s Trade Surplus Widened with Declining Imports in September

According to the National Institute of Statistics (or ISTAT), Italy’s goods and services surplus rose to 2.2 billion euros in September 2015 compared to 2.0 billion euros a year ago.