Lincoln National Corp

Latest Lincoln National Corp News and Updates

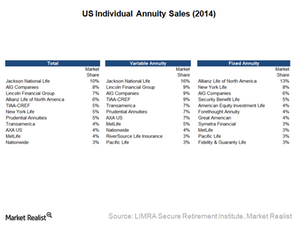

Leading Players in the US Annuity Industry

The market leader in the fixed annuity industry is Allianz Life Insurance Company of North America with 13% market share, followed by New York Life with 8%.

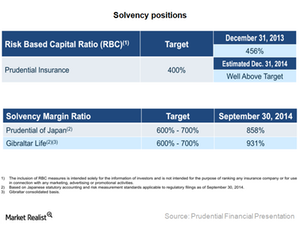

Prudential Financial Enjoys Strong Solvency Ratios

Prudential has comfortable solvency positions in its subsidiaries. In the US, Prudential Insurance’s solvency ratio was well above the target ratio of 400%.