Lumentum Holdings Inc.

Latest Lumentum Holdings Inc. News and Updates

The Top 5 Augmented Reality Stocks to Buy

Check out these augmented reality stocks to buy as the space heats up! AR is making waves because of its massive potential in virtually all industries.

Here’s Apple’s Answer to iPhone Demand Problem

Apple is considering pricing the iPhone in local currency outside the United States.

How Sluggish Demand for iPhones Is Hurting Apple’s Revenue

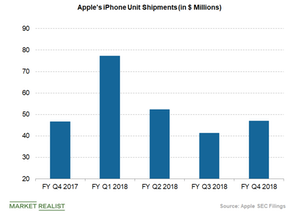

In the fourth quarter of fiscal 2018, Apple’s (AAPL) iPhone sales rose 29% YoY (year-over-year) to $37.2 billion.