Loews Corp

Latest Loews Corp News and Updates

Kroger versus Walmart: Which Grocery Stock Is Best?

Despite some impressive signs of Kroger’s (K) success, Walmart stock (WMT) is the better pick for the grocery sector. Here’s why.

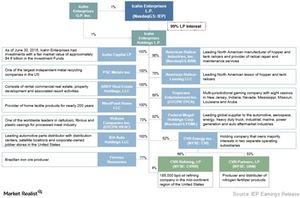

A Look at Icahn Enterprises’ Business Model

Icahn Enterprises’ investment strategy involves identifying and purchasing undervalued businesses and assets at distressed prices.