PowerShares KBW Bank ETF

Latest PowerShares KBW Bank ETF News and Updates

Wells Fargo to Cut Over 600 Jobs amid Mortgage Business Slowdown

On August 23, Wells Fargo (WFC) announced that it planned to terminate the jobs of 638 employees in its home mortgage division.

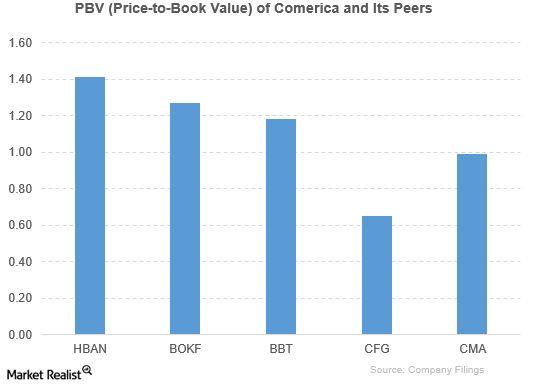

How Did Comerica Perform Compared to Its Peers?

The peers outperformed Comerica based on the PBV ratio. However, Comerica is way ahead of its peers based on the forward PE ratio.