iShares Morningstar Small-Cap Growth

Latest iShares Morningstar Small-Cap Growth News and Updates

Inside Kate Spade’s Key Focus Areas

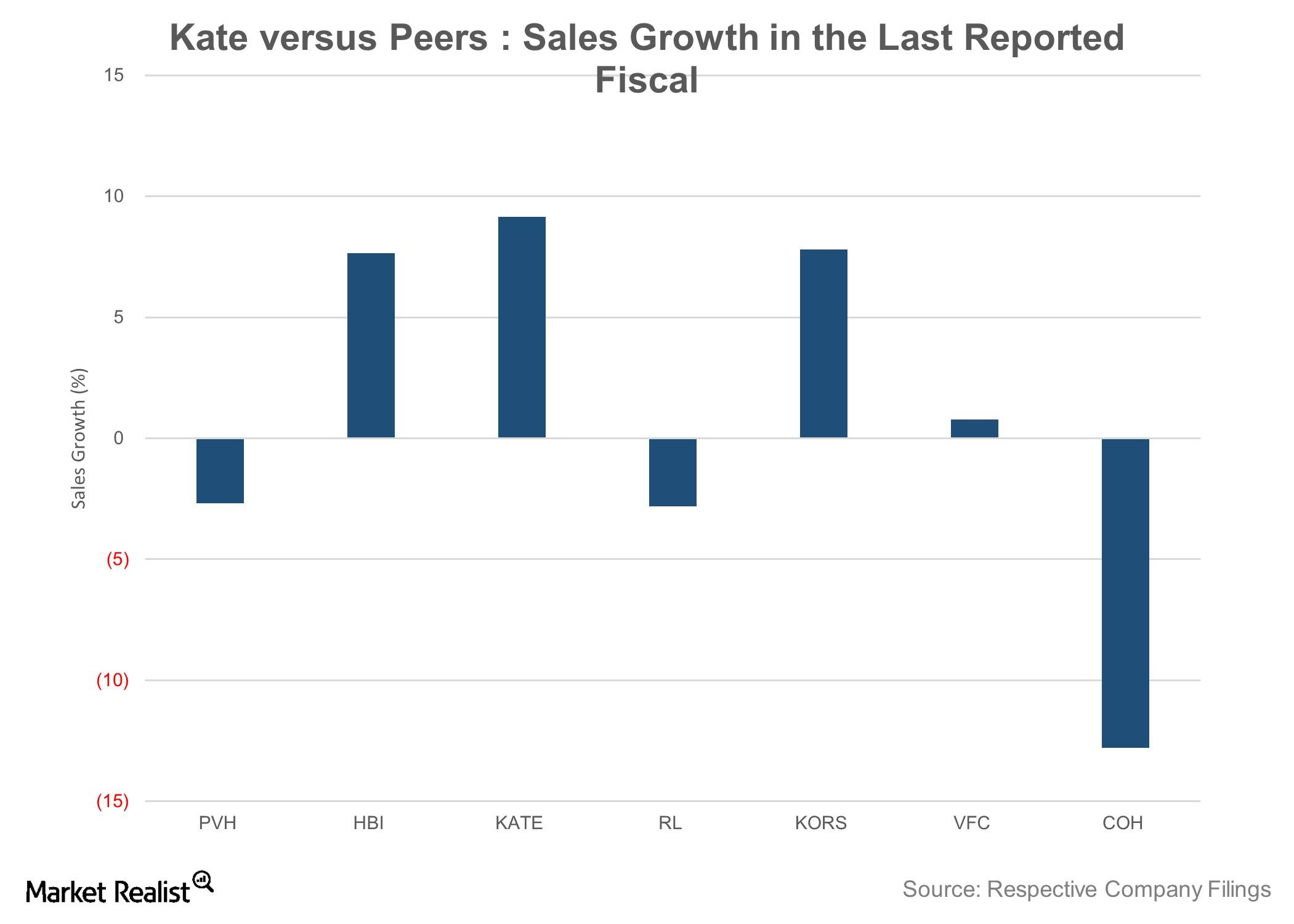

KATE’s top line grew by 9.1% YoY (year-over-year) in fiscal 2015, as compared to a 7.7% YoY increase for Michael Kors and a 12.7% YoY decline for Coach.

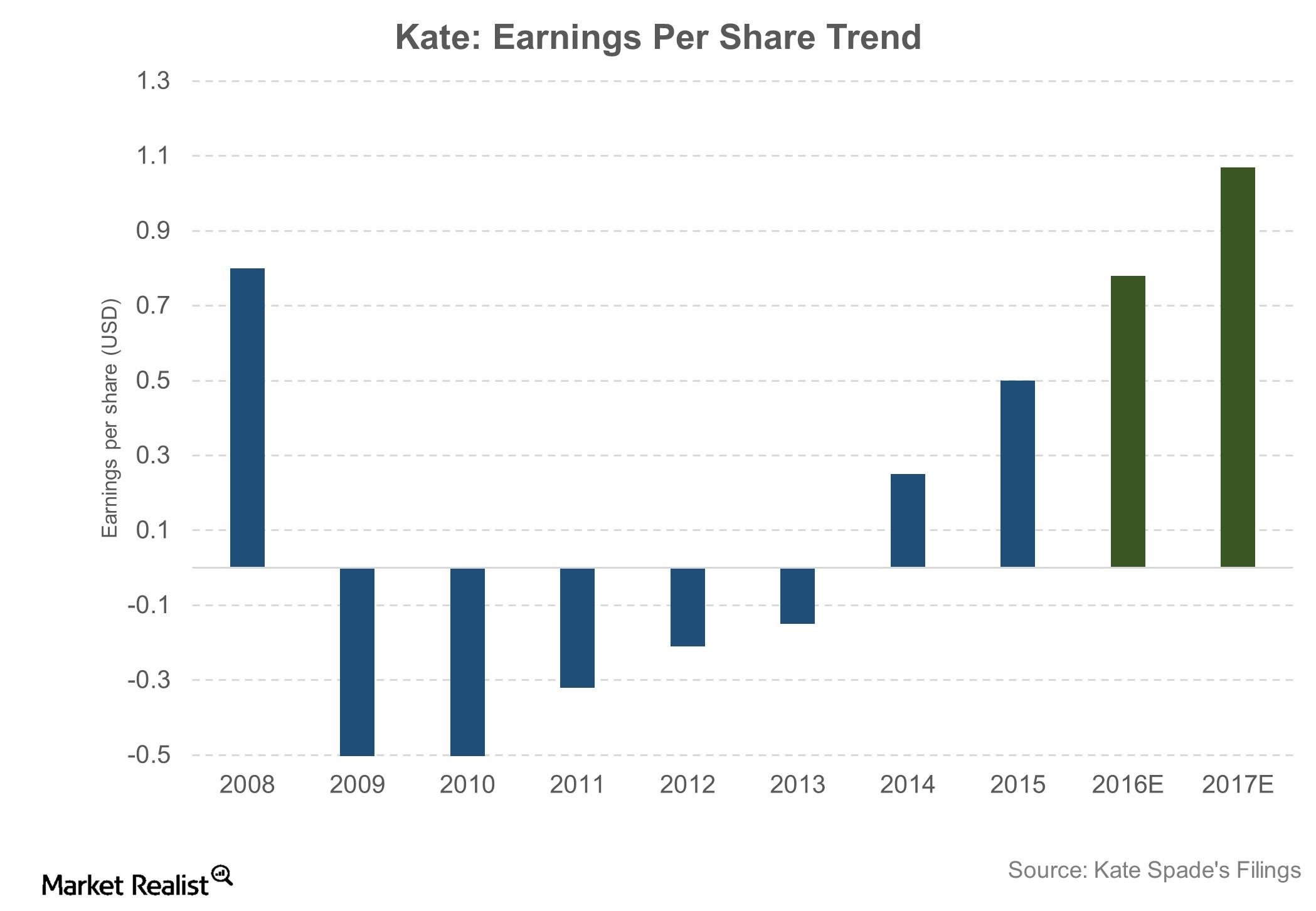

What Lies ahead for Kate Spade?

Kate Spade has predicted that its top-line growth will be in the 11.0%–13.5% range in fiscal 2016, which is in line with the consensus average of 13.5%.