Imperial Tobacco Group PLC

Latest Imperial Tobacco Group PLC News and Updates

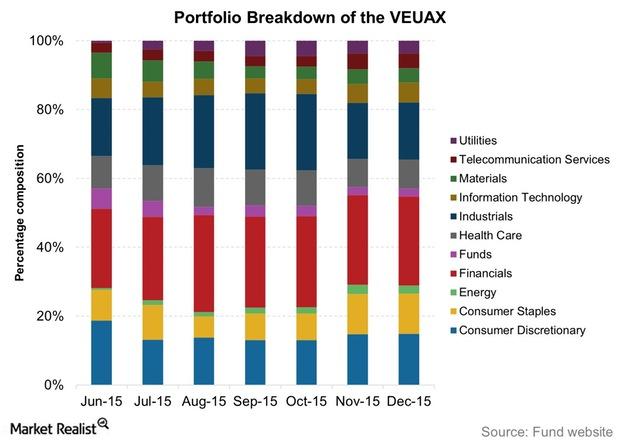

Analyzing JPMorgan Intrepid European Fund’s Allocation in 2015

The JPMorgan Intrepid European Fund’s assets were spread across 79 holdings as of December 2015.

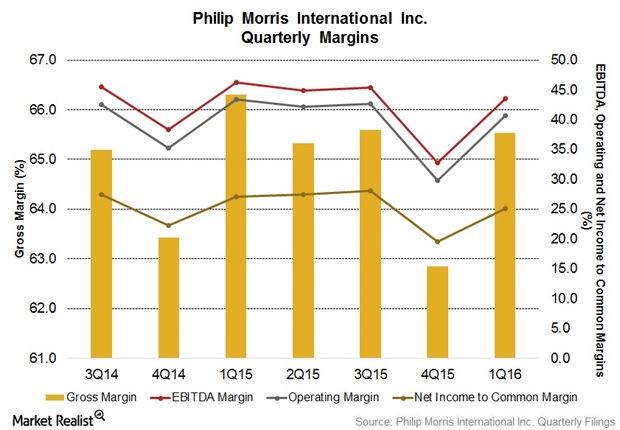

Can ~6% Pricing Variance Help Philip Morris’s Margin Rise in 2Q16?

As a result of decreased operating income, Philip Morris’s (PM) operating margin fell by 2.8% to 41.9% in 1Q16.