Howard Hughes Corporation

Latest Howard Hughes Corporation News and Updates

More Than 600 People Claimed a Share of Howard Hughes’ Estate

What happened to Howard Hughes’ money? The billionaire died reportedly without a valid will, and more than 600 people wanted in on his estate.

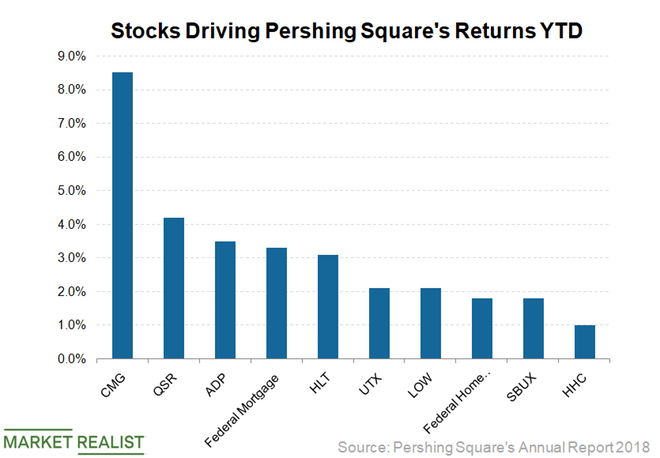

Bill Ackman Thanks Warren Buffett for His Fund’s Comeback in 2019

Bill Ackman has made a huge comeback in 2019.