Fidelity National Financial Inc

Latest Fidelity National Financial Inc News and Updates

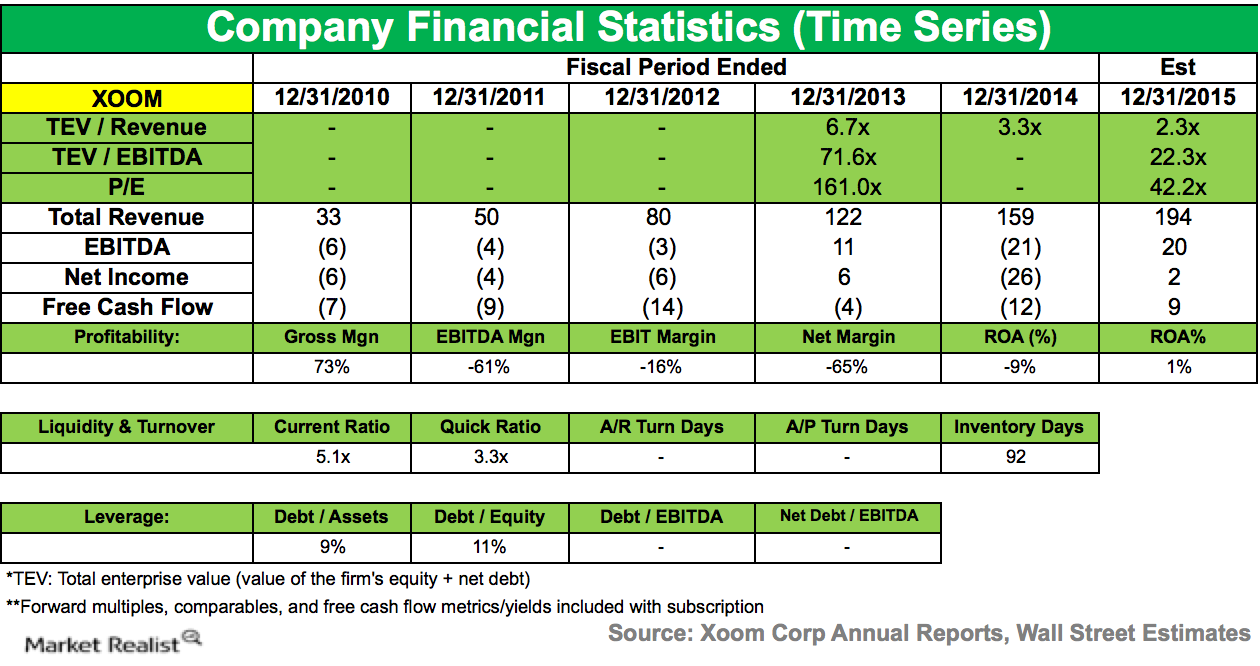

Eminence Capital raises its position in Xoom

Increased mobile adoption of Xoom’s mobile products led Latin America revenue, which rose 48% YoY. Gross sending volume increased 29% YoY.

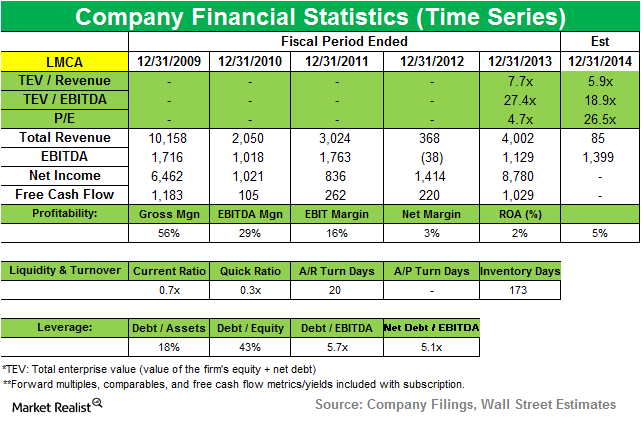

CalPERS adds new position in Liberty Media

Liberty Media Corporation owns interests in a range of communications and entertainment businesses. Recently, the company completed the previously announced spin-off of its cable business, Liberty Broadband.