Flowserve Corp

Latest Flowserve Corp News and Updates

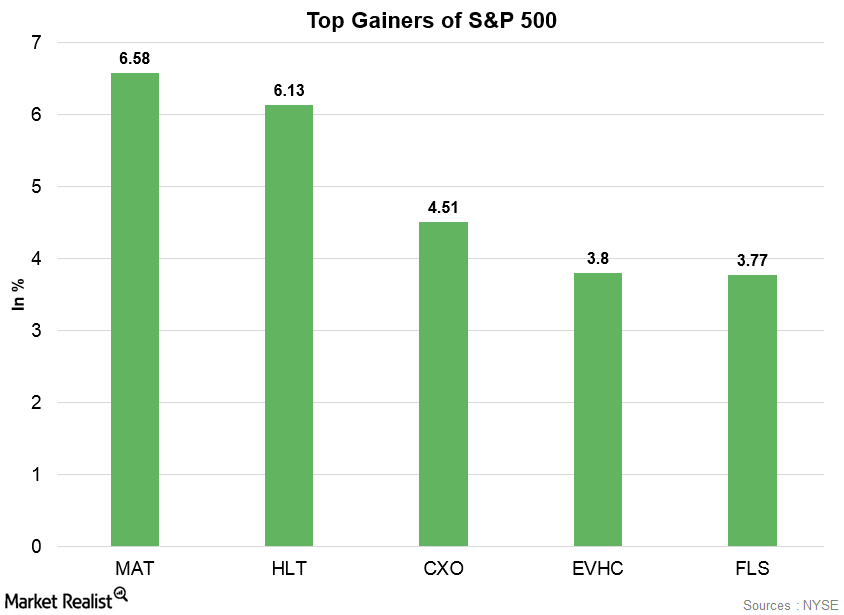

Mattel: S&P 500’s Top Gainer on April 11

Mattel, which is an American multinational toy manufacturing company, was the S&P 500’s top gainer on Wednesday.

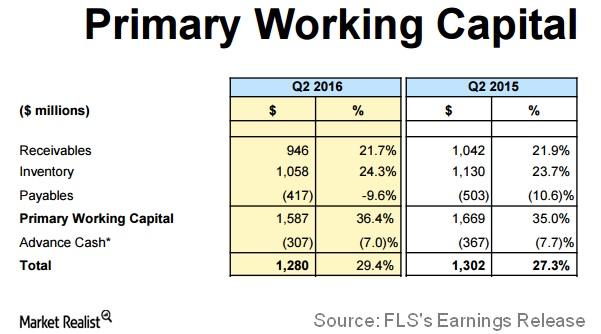

A Glance at Flowserve’s Primary Working Capital after 2Q16

In the current volatile global scenario, Flowserve’s (FLS) 2Q16 revenue and net profit have risen by 11% and 28%, respectively, year-over-year.

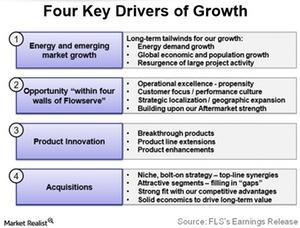

Why Do Customers Buy Flowserve’s Products?

After 4Q15, FLS reported that it controlled a market share of 4% of the $130-billion pump, valve, and seal market in 2015.

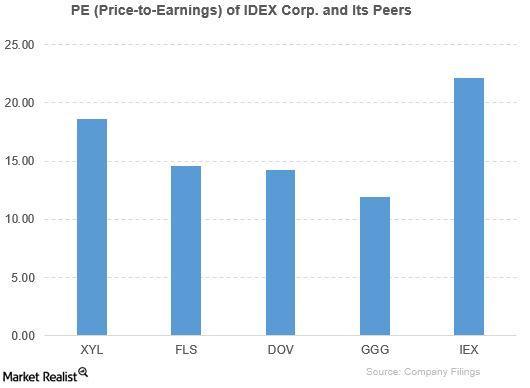

How Does IDEX Compare to Its Peers?

IDEX outperformed its peers based on the PE ratio and PBV ratio. The ETFs outperformed it based on the PE ratio. It’s ahead of its ETFs based on the PBV ratio.