Forum Energy Technologies Inc

Latest Forum Energy Technologies Inc News and Updates

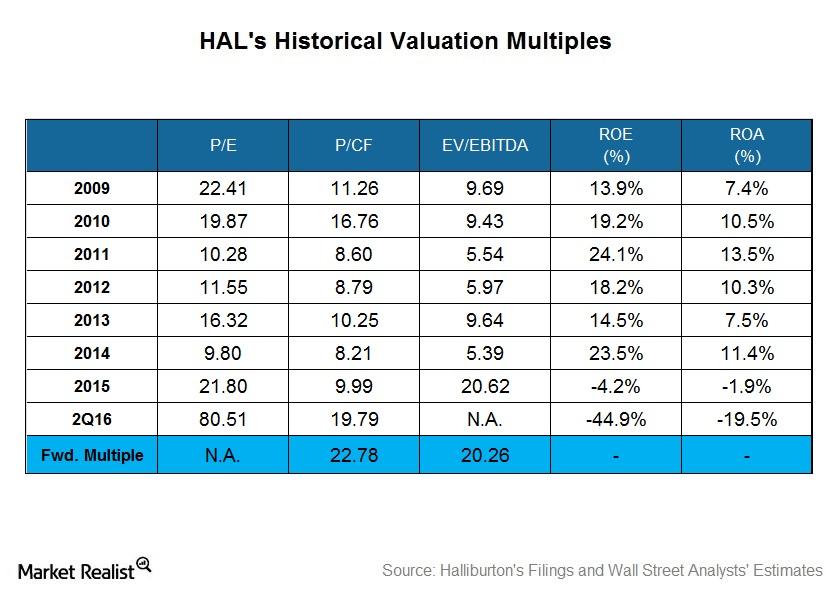

Explaining Halliburton’s Historical Valuation

A steeper earnings decline compared to the decline in its share price caused Halliburton’s (HAL) PE multiple to expand in 2015.

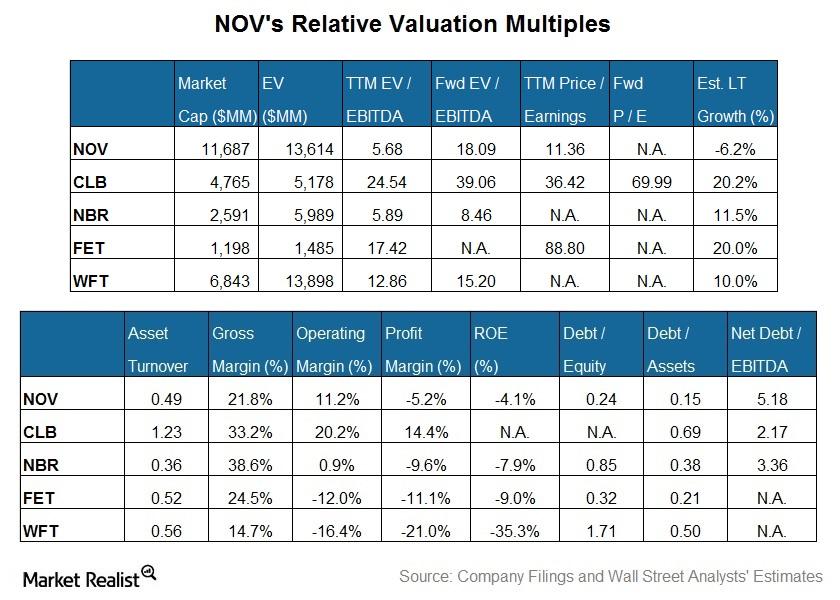

What Is NOV’s Valuation Compared to Its Peers’?

NOV’s enterprise value, when scaled by trailing-12-month adjusted EBITDA, is lower than the peer average.