ELEMENTS Dogs of Dow DJ HY Sel 10 TR ETN

Latest ELEMENTS Dogs of Dow DJ HY Sel 10 TR ETN News and Updates

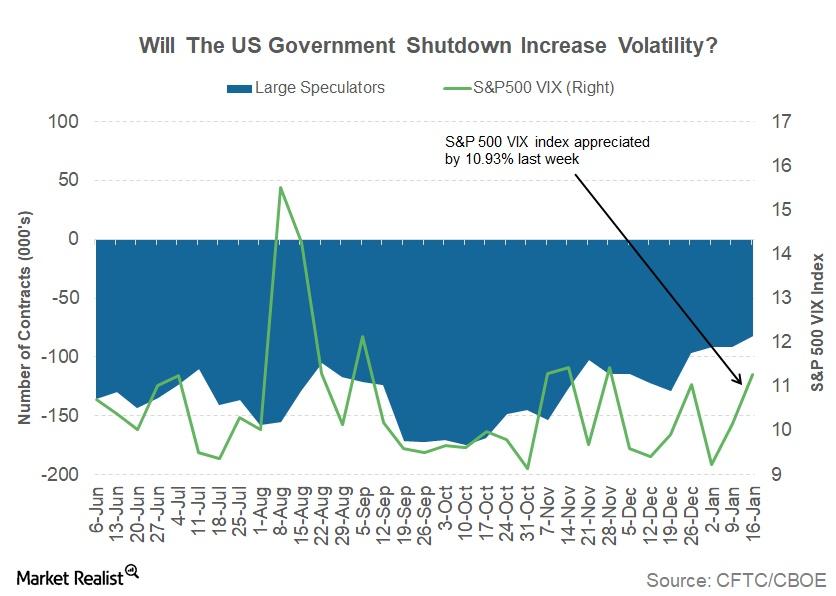

Could the US Government Shutdown Impact Market Volatility?

During the week ended January 19, 2018, global markets trended higher despite the possibility of a US government shutdown. The potential shutdown pushed volatility up.

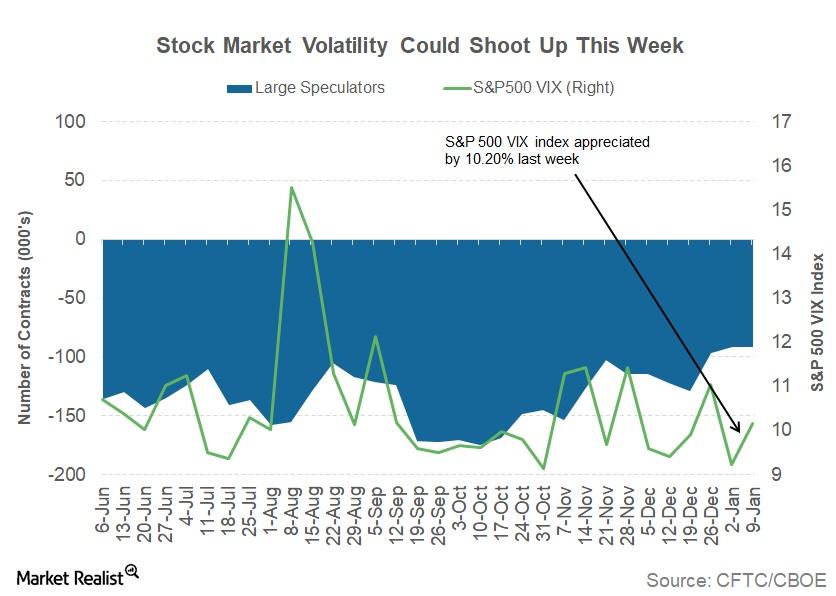

Could the Threat of a US Government Shutdown Spike Volatility?

The Dow Jones Industrial Average appreciated ~1.6% for the week ended January 12, 2018, while the S&P 500 (SPY) returned ~1.3%. The tech-heavy NASDAQ (QQQ) posted a weekly gain of ~1.4%.

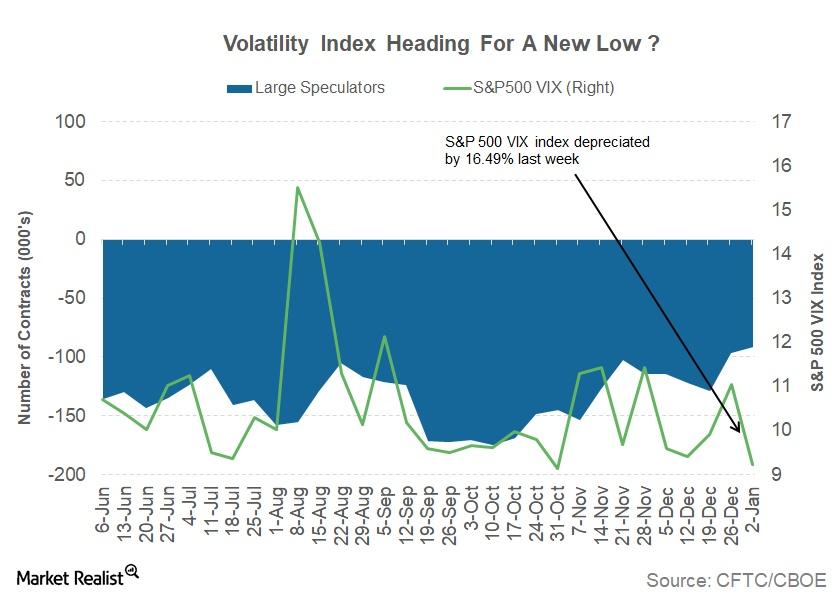

Why Volatility Fell 16% in Week 1 of 2018

Every segment of the global financial markets began 2018 on a positive note. The global equity rally extended in the first week of the year.