Baytex Energy Corp

Latest Baytex Energy Corp News and Updates

Will Saudi Arabia’s Production and Exports Support Crude Oil Futures?

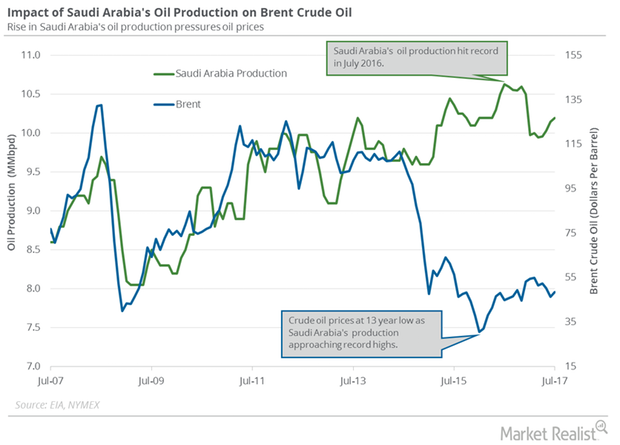

The EIA (U.S. Energy Information Administration) estimates that Saudi Arabia’s crude oil production rose by 50,000 bpd (barrels per day) to 10.20 MMbpd (million barrels per day) in July 2017 compared to the previous month.

Will Crude Oil Futures Rise or Fall This Week?

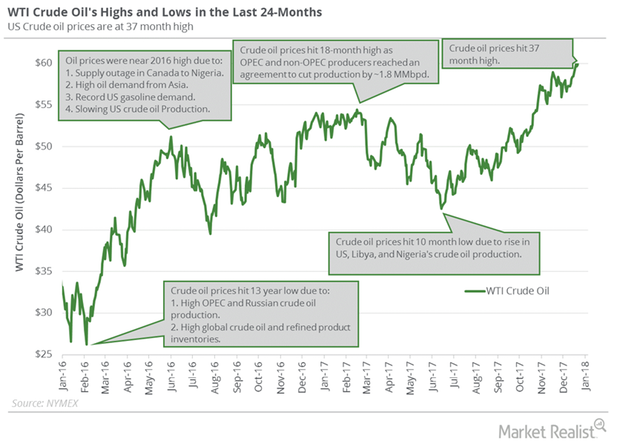

WTI crude oil (SCO) futures settled at $64.30 per barrel on January 12, 2018—the highest level since December 2014.

Crude Oil Futures: Next Important Resistance Level

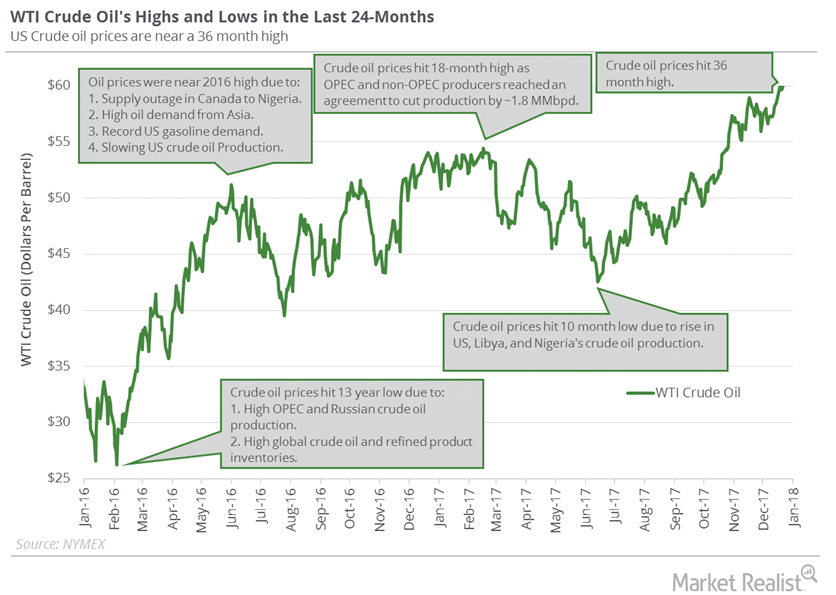

WTI crude oil (UCO) futures closed at $62.01 per barrel on January 4, 2018—the highest level since December 2014. WTI prices rose ~12.4% in 2017.