B/E Aerospace Inc

Latest B/E Aerospace Inc News and Updates

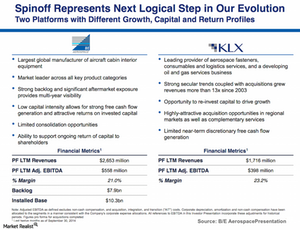

B/E Aerospace spun off KLX business on activist push

On December 17, 2014, B/E Aerospace completed its spin-off of KLX, Inc., from B/E Aerospace, and KLX started trading on NASDAQ under the ticker symbol KLXI.

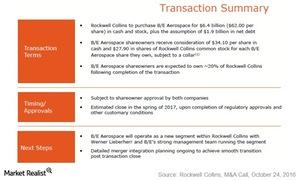

Rockwell Collins Acquires B/E Aerospace in a Deal-Making Weekend

On October 23, Rockwell Collins (COL) announced that it intends to acquire B/E Aerospace (BEAV) for a total consideration of $8.3 billion. Within Rockwell Collins, B/E Aerospace will operate as its new Aircraft Interior Systems segment.