Will the PPP Loan Open Back Up? Small Business Owners Still Struggle

Small-business owners who haven't applied for the PPP (Paycheck Protection Program) loan yet will need to find alternate financing since the PPP has closed.

June 30 2021, Published 10:33 a.m. ET

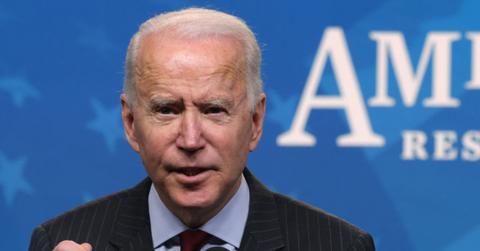

President Biden discussing PPP loans for small businesses in February 2021.

Small business owners and sole proprietors who have missed the application window for the PPP (Paycheck Protection Program) might wonder if they’ll get another opportunity. The forgivable PPP loans, intended to help small businesses continue paying their bills and employees throughout the COVID-19 pandemic, aren't available anymore.

The PPP officially closed to new loan applications on May 28. The original deadline to apply was May 31, but the SBA (Small Business Administration) ended up closing applications early due to the high volume of applications and minimal remaining funding available.

Although many businesses still haven't received loans through the program, there doesn’t appear to be any U.S. government plan to introduce an extension of the PPP.

Why the PPP closed early

The PPP was a form of financial aid provided to businesses that were forced to close their doors and furlough workers due to restrictions amid the COVID-19 pandemic. The PPP was included as a part of the CARES Act originally signed into law in March 2020.

The PPP quickly ran out of funds for both the First Draw and Second Draw. The first round of PPP loan funds was exhausted quickly (often by surprisingly large businesses). When applications opened again this spring, the funds ran out faster than expected as well, with huge numbers of small businesses struggling.

In February 2021, the Biden administration implemented a 14-day exclusivity period for businesses of 20 or fewer employees to apply. The administration hoped to avoid so many businesses being left out of funding.

Reasons for PPP loan delays or rejections

Some people who applied for the PPP were denied funds. Some rejections were due to not meeting all of the requirements set by the SBA, like the number of employees or how long they have been in business. Loans have also been denied or delayed due to minor errors on the application.

Business owners have also experienced difficulties with the application process. Some delayed submission of their PPP application in order to wait until they had filed their 2020 taxes, as CNBC reported in May.

Alternatives to PPP loans

Unfortunately, small businesses that were counting on assistance from the PPP to help bridge the continuing gaps in their budgets won't be able to secure a loan from that program. There are some alternatives to PPP loans that could help business owners.

The Shuttered Venue Operators Grant Program provided financial assistance to entertainment venues that were forced to shut down or operate on reduced capacity.

The Restaurant Revitalization Fund has closed to new applicants.

Currently, SBA 7(a) loans are the most common loans with a maximum loan amount of $5 million.

With SBA CDC/504 loans, long-term fixed-rate financing is available for major fixed assets helping to advance business growth and create jobs.

With SBA microloans, up to $50,000 is available to start or expand a business. These loans are for small businesses and some non-profit childcare centers.

Although the PPP has run out of money and isn't accepting applications, business owners might have other options for financing as they rebuild following the COVID-19 pandemic.