Will the Housing Market Crash Like 2008? Experts Say 'No'

Markets have been getting apprehensive of a bubble and a crash. Will the U.S. housing market crash in 2021?

May 20 2021, Published 10:20 a.m. ET

Everything that goes up must come down, and many people wonder if a crash is in store for the housing market. There has been a splendid bull market in the U.S. real estate industry led by strong demand and tepid supply. The historically low-interest rates have also supported the housing markets. Could the U.S. housing market crash in 2021?

Most real estate analysts don’t see a housing market crash on the horizon. The general view is that the U.S. housing market is undersupplied. The labor shortage situation has also been taking a toll on new home construction.

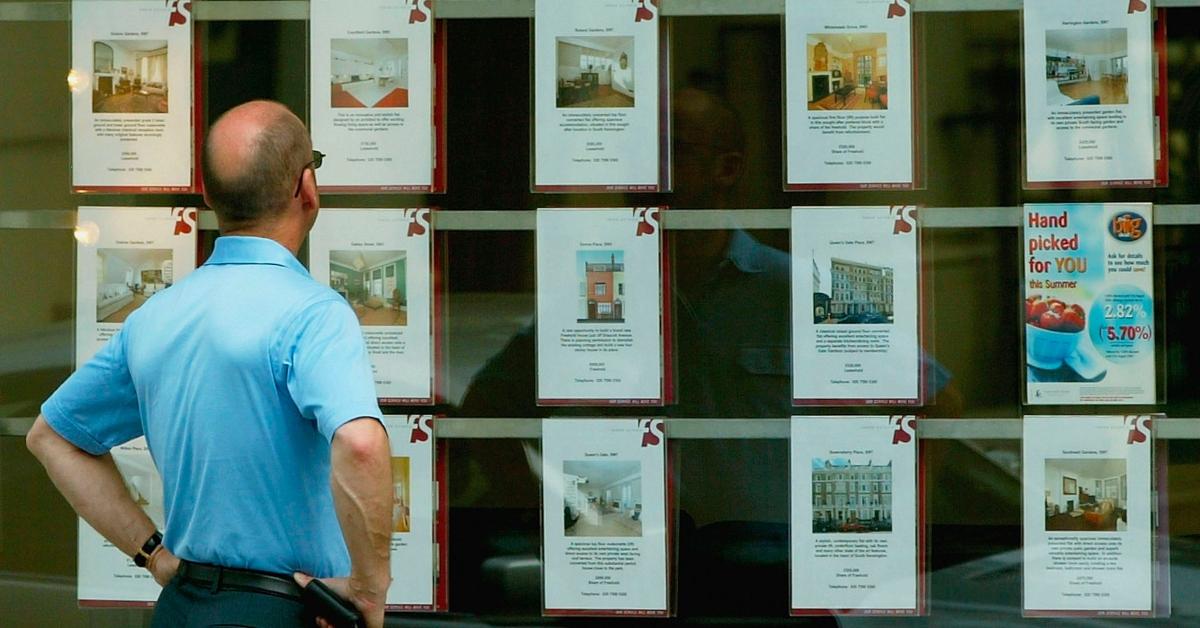

High prices and limited supply define the current housing market.

The median housing prices in the U.S. have been on an uptrend. The booming U.S. economy has also been supporting housing demand.

The increase is fueled by record low-interest rates, combined with a limited supply of available homes for sale in the market.

Because of the limited home supply, sellers get well over their asking prices as buyers often get in bidding wars over homes.

Analysts on U.S. housing market crash

Meanwhile, not everyone buys the story that the U.S. housing market is undersupplied. Ivy Zelman, who called the top of the housing market in 2015, doesn't think that there's a scarcity of homes.

“The perception that housing is drastically undersupplied and that a strong demographic picture lies ahead is creating a false sense of security,’’ said a report by Zelman’s firm Zelman Associates, which was titled “Cradle to Grave.’’ The report added, “By our math, both single-family and multi-family production are already ahead of normalized demand and estimates of a housing deficit are grossly exaggerated.’’

Many people see Zillow's decision to exit the home-flipping business as a sign of an impending crash in the housing market. The stock tanked after Zillow said that it would exit the home-flipping business. Cathie Wood of ARK Invest also sold Zillow stock after the announcement.

Housing market in 2021 compared to 2008

There are several differences between the real estate market in 2021 and that of the subprime mortgage crisis of 2006–2008.

A significant factor in the 2000s crisis was the subprime mortgages that enabled less qualified borrowers to get home loans. However, the credit quality of banks' mortgage portfolios in 2021 is far better than it was during the 2008 housing market crash.

Also, in an opposite scenario than 2021, the supply of homes for sale exceeded the demand from buyers. This caused home prices to plummet to the point where homeowners owed more than the value of their homes. Many homeowners choose to walk away from their mortgages and send their homes into foreclosure.

The housing bubble of 1990

Another housing bubble burst in the early 1990s. After rising steadily throughout the 1980s, home prices peaked in 1989 right before a recession in 1990. By the end of 1990, home prices had fallen 7 percent from their peak.

Although the recession ended in early 1990, home prices continued to fall until 1997 when they were down 14 percent from 1989. Many cities didn’t see home prices return to 1989 peak levels for 13–15 years.

Don't expect big declines in home prices.

Will the current home prices eventually fall again to a level where buyers owe more than their home is worth? As things stand now, it doesn't seem like a realistic possibility. However, moderation in prices is something that can't be ruled out.

Paul Buege, the president and COO of Inlanta Mortgage, also holds similar views. According to Buege, “With more homes on the market, prices should begin to moderate. This suggests that the balance between sellers and buyers will shift toward a more normalized market next year.”

Another aspect worth watching would be the Fed's monetary policy. The U.S. Central Bank has already started tapering and sticky inflation would force its hand into raising rates sooner than what markets are expecting. If the Fed takes a hawkish stance on inflation, it could lead to a spike in bond yields and mortgage rates. A steep rise in mortgage rates is a negative for the housing market.

Michael Burry on housing market crash

Michael Burry famously bet against the U.S. housing markets through CDOs in the 2008 crash. While he hasn't recently commented on a housing bubble and crash, he warned of an asset bubble in his deleted tweets.

U.S. housing looks in far better shape than it did before the crash of 2008. The rate hikes by the Fed is an overhang but the U.S. Central Bank has indicated through its actions that it wouldn't like to disturb the economic recovery through aggressive rate hikes.