The Debt Ceiling Deadline is Approaching—It's Dec. 3, to Be Exact

Congress has been given until Dec. 3, 2021, to address the debt limit. Whether Congress will raise the debt limit or repeal it is unclear.

Nov. 10 2021, Published 6:52 p.m. ET

Congress has been given the deadline of Dec. 3, 2021, to raise the debt ceiling, though it isn’t clear if an agreement will be reached in time. Congress nearly missed the deadline to increase spending limits in Oct. 2021, which would have resulted in yet another government shutdown.

What's the debt ceiling, and why is Congress being pressured to raise it?

The debt ceiling, explained

The debt ceiling refers to the maximum amount of money the government can borrow to cover expenses such as Social Security and Medicare benefits, tax refunds, and military salaries. The term “debt ceiling” is often used interchangeably with “debt limit.”

The debt limit doesn't exactly allow the government to take up “new spending commitments,” according to the U.S. Department of the Treasury, but instead, it allows the government to “finance existing legal obligations that Congresses and presidents of both parties have made in the past.”

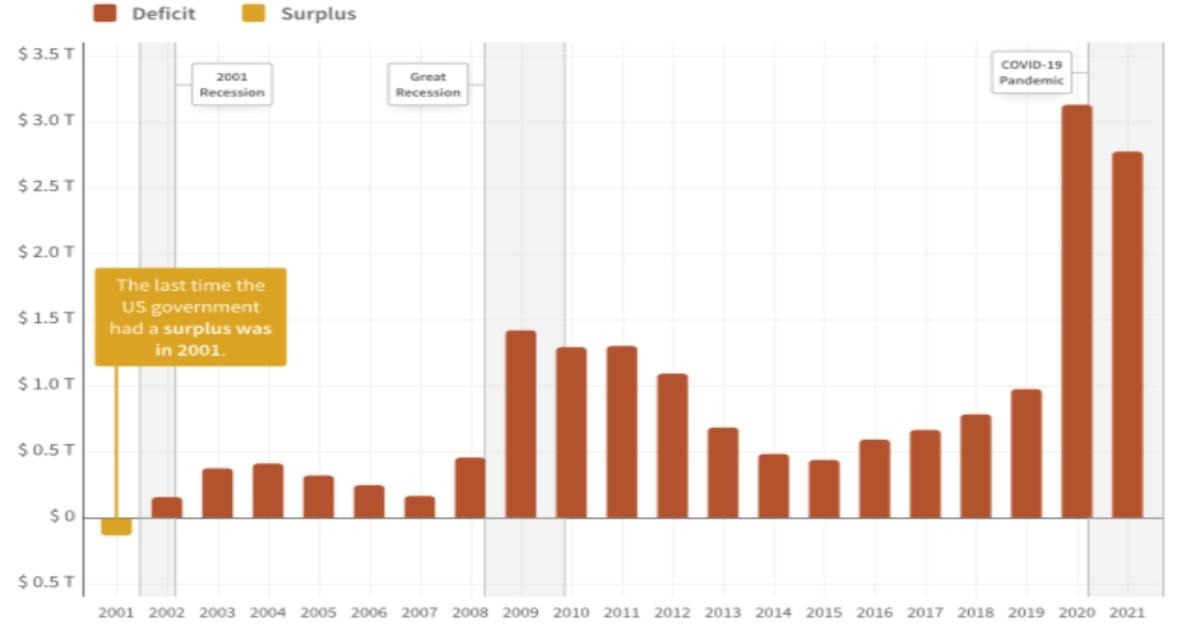

When the debt limit isn't increased, it can have devastating effects on the economy. The government would “default on its legal obligations,” which could cause other types of financial crises. Since 2001, the U.S. has been spending more than it sees in taxes and revenue, causing the country to run on a budget deficit.

In 2019, the U.S. debt limit reached $1 trillion, and then increased to more than $3 trillion around the time the COVID-19 pandemic hit. Though the amount the U.S. has acquired in debt did drop in 2021 to just over $2.5 trillion, it hasn't experienced a well-needed surplus in years.

In July 2019, Congress agreed to suspend the debt limit until July 31, 2021. Once it was reinstated on Aug. 1, the limit was then raised to $28.5 trillion.

How many times has the debt ceiling been raised?

You’ve likely heard politicians and government officials discussing raising the debt ceiling, particularly after the COVID-19 pandemic started. The U.S. economy has taken a significant hit because of it and has since had to raise spending limits to keep it afloat.

Though the discussion of raising the debt ceiling is one that seems to get a lot of attention lately, this process of increasing government spending limits has been going on for years. Since 1960, Congress has stepped up on several occasions to raise or temporarily extend the debt ceiling, or revise what the debt limit means. Congress has had to act 49 times while the U.S. was led by Republican presidents and 29 times under Democratic presidents.

What happens if the debt ceiling isn't raised prior to Dec. 3, 2021?

On Oct. 7, the Senate agreed to a short-term deal in a 50-to-48 vote that would raise the debt ceiling. This prevented the government from shutting down, allowing it to continue making payments to federal workers and issuing child tax credits that were approved under Biden’s American Rescue Plan.

Unless Republicans and Democrats can find a way to revise the government’s spending limit or repeal the debt limit altogether, Treasury reportedly “only has enough funds to pay the country’s bills through early December.” Sadly, a full or partial government shutdown often happens in conjunction with hitting the debt ceiling.

Treasury Secretary Janet L. Yellen has already shown support for abolishing the debt limit, claiming that "the borrowing cap is "destructive" and poses unncesary risks to the economy, reports The New York Times.