Stay HUMBL: What Happened to TSNP Stock?

HUMBL Inc., trading under the ticker "TSNP," performed a reverse stock split. Here's what that means for investors.

March 3 2021, Published 11:33 a.m. ET

Now trading under the ticker symbol "TSNPD" on the OTC markets, Tesoro Enterprises investors have felt a little lost looking for their securities. Once they found them, they might have noticed that their number of shares shrunk, but the value of those shares remained the same. That's because Tesoro went through a reverse stock split and changed its name to HUMBL Inc. in the process.

Here's how the reverse stock split impacted investors, and what to expect for TSNP stock to come.

What happened to TSNP stock?

Tesoro Enterprises has officially changed its name to HUMBL Inc. Formerly allocated as TSNP, HUMBL has added an extra letter to the ticker symbol to get TSNPD. That might have caused some confusion among investors who were looking to see how the stock was faring by searching with the ticker.

Tesoro and HUMBL merged in December 2020. Since then, the Financial Industry Regulatory Authority (FINRA) gave the company the go-ahead to change its name to HUMBL.

How a reverse stock split impacts TSNPD investors

Before the split, TSNP was trading at $0.85 per share. After the split, that value went up to about $3–$4, even as much as $5 at one point. The company experienced a 1:4 reverse split, which means four shares became one.

At the same time, HUMBL's trading volume increased tremendously. The reverse stock split could be at the root of this. Companies use price inflation tactics like this to lure in investors, effectively taking the penny stock title off of the table and eliminating risk associations. This is particularly effective when dealing with Pink Sheet stocks.

TSNPD's outlook

On March 1, HUMBL announced that it was acquiring a company called Tickeri, Inc. The recent acquisition only strengthens HUMBL's standing and shows the corporate demand for growth following an already lucrative merger.

Once the enthusiasm wanes a bit, investors might find it wise to hop in on HUMBL on the dip. Using a top-tier broker like Fidelity, TD Ameritrade, E-Trade, or Schwab will give you the opportunity to trade OTC. You won't find this stock on Robinhood or similar trading apps.

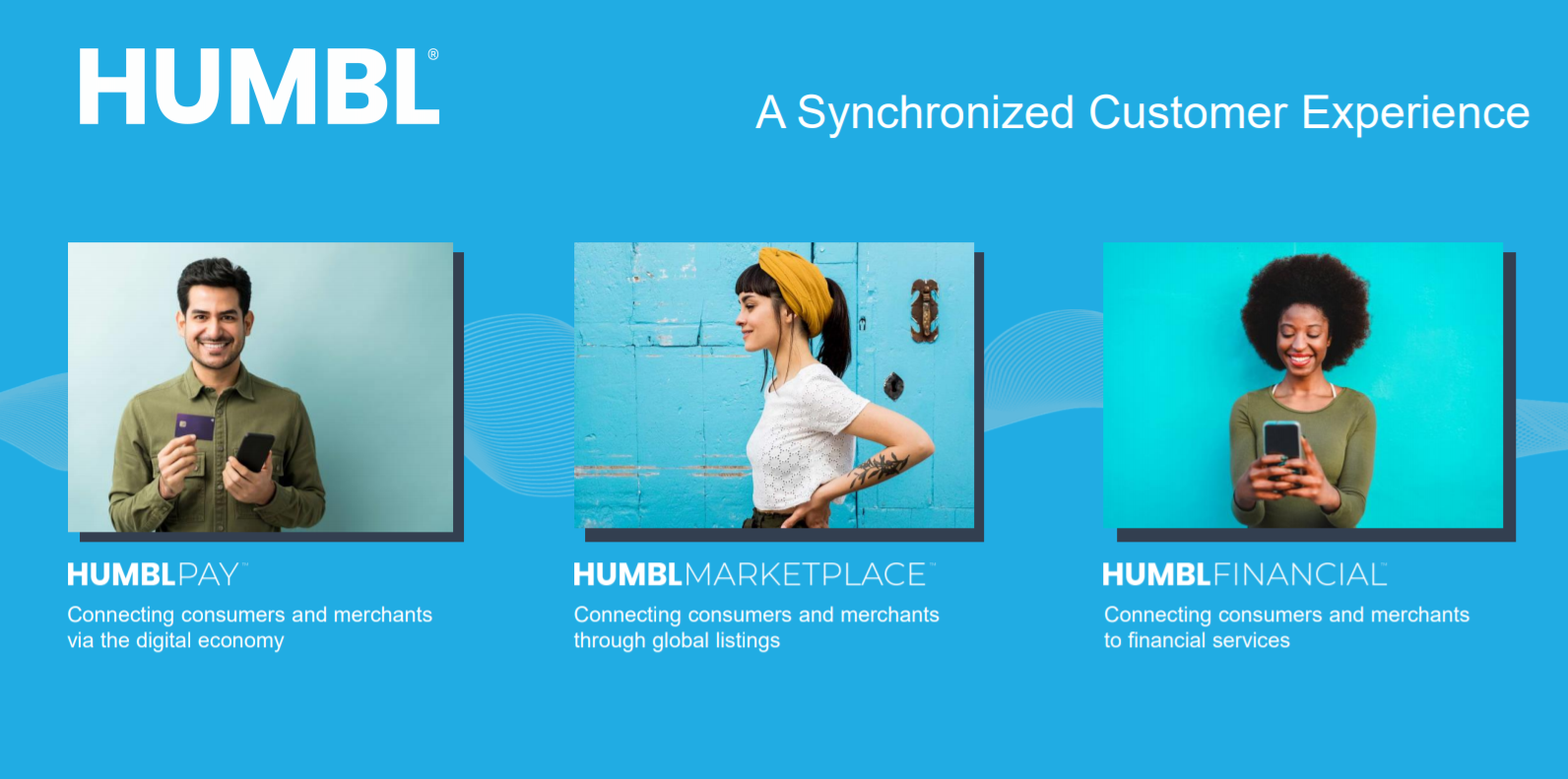

As part of the digital economy, HUMBL is aptly positioned to succeed in an increasingly digitized world. Offerings like HUMBL Pay (a Square-like product) and HUMBL Financial prove that fintech has a place in the future. Plus, HUMBL's diversified offerings allow for numerous ways to succeed, which is good news for investors. There's even blockchain technology in the mix, which is a big divergence from Tesoro's initial offerings of floor and wall coverings.

If the company has more acquisitions lined up, HUMBL's rally could go on for quite some time. The shares went up 132 percent from December 1, 2020, to February 1, 2021. The following week brought a 332.91 percent gain.

Since then, the shares have dropped about 45 percent, but HUMBL Inc. remains a tentative possibility for long-term success. A firm buy would have to wait until HUMBL declares more about its future plans, and how it plans to market its multi-sector brand.