FedLoan to Phase Out Federal Student Loan Servicing, Starts Now

One of the key federal student loan servicers in the U.S., FedLoan, is stepping back from its role. Here's what's happening.

Aug. 3 2021, Published 1:09 p.m. ET

With a reconfigured economy, loan processors are rethinking their priorities. First, Wells Fargo canceled personal lines of credit. Now, federal student loans are the target. Federal student loan servicer FedLoan is phasing out all of its loans, starting now.

Why is FedLoan transferring all of the student loans it services? What will happen to students' and graduates' debt?

FedLoan is skipping out on servicing federal student loans.

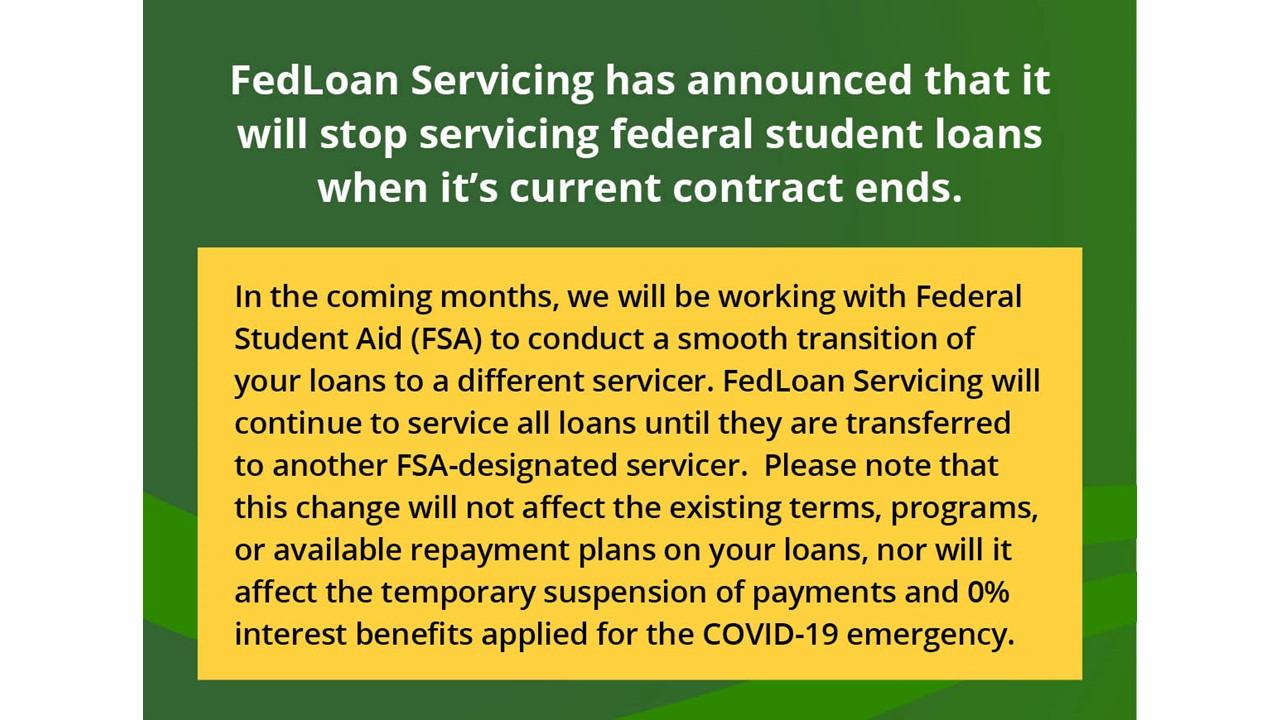

FedLoan (also known as Pennsylvania Higher Education Assistance Agency or PHEAA) recently sent a notice to people with federal student loans through the company. FedLoan told the students and graduates that it will be working with FSA (Federal Student Aid) during the rest of 2021 to conduct a smooth transition of all loans to a different servicer.

FedLoan Servicing acknowledged that it will continue to service all existing loans until it's able to transfer them to another servicer that's designated by FSA.

The FedLoan contract with FSA is ending after 12 years.

FedLoan maintained its contract with FSA for 12 years, but the firm isn't renewing it again. The shift will impact about a fifth of all student loan borrowers in the U.S., which amounts to approximately 8.5 million people.

While the loan servicer hasn't come forth with a direct reason as to why it isn't renewing the contract, the COVID-19 pandemic likely has a lot to do with it. A pause on federal student loan payments was one of the first measures to go into place to help prop up the economy. The pause is still ongoing, which makes it one of the most lasting pandemic protections.

What will happen to your student loan?

Despite the fact that FedLoan is dropping student loan servicing, borrowers reportedly won't experience much impact. All of the existing terms, programs, or repayment plans tied to your loans will stay in place.

The loan repayment moratorium will stay in place as long as the U.S. government maintains it. Any zero percent interest benefits applied to your loan during the COVID-19 emergency will also stay put.

What's the worst part about FedLoan's student loan servicing contract ending?

Of those 8.5 million borrowers with loans through FedLoan, many of them were people who work for a qualified public service or nonprofit employer after graduation.

FedLoan was the only federal student loan servicer offering the PSLF (Public Service Loan Forgiveness) program, which forgives the remaining balance on direct loans after the borrower has made 120 monthly payments under a repayment plan while working full-time for a nonprofit or public service employee.

It isn't clear whether another federal student loan servicer will step up to the plate and participate in the PSLF program. Until then, students who plan to go into nonprofit work (or graduates who are already there) will have to reassess their student loan repayment plan. Those pricey educations might not be forgiven as quickly as they thought, if at all.