TAE Technologies Gets $280 Million Funding Boost, No IPO in Sight

Nuclear fusion technology developer TAE Technologies announced on April 8 that it secured $280 million in funding. Does it have IPO plans?

April 9 2021, Published 1:49 p.m. ET

California company TAE Technologies is one step closer to harnessing the power of the stars. Does the company have any IPO plans?

TAE Technologies, a nuclear fusion technology developer, announced on April 8 that it secured another $280 million in funding to help take its landmark fusion technology on a path to commercialization. However, company officials didn't mention whether TAE Technologies will go public anytime soon.

TAE Technologies in the news

Touting itself as the world’s largest private fusion energy company, TAE Technologies officials say that the additional funding is a direct result of its recent scientific milestone of producing stable plasma at 50 million degrees Celsius (90 million degrees Fahrenheit). That is hotter than the sun, which is 15 million degrees at its core.

By generating such stable high-temperature plasmas, TAE has now validated that its unique approach can scale to the conditions necessary for an economically viable commercial fusion power plant by the end of the decade, the company said in a statement.

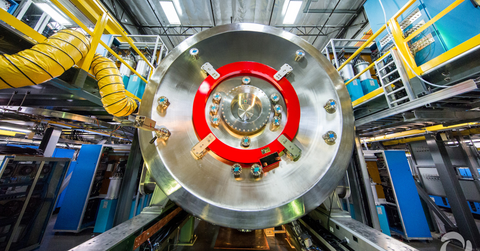

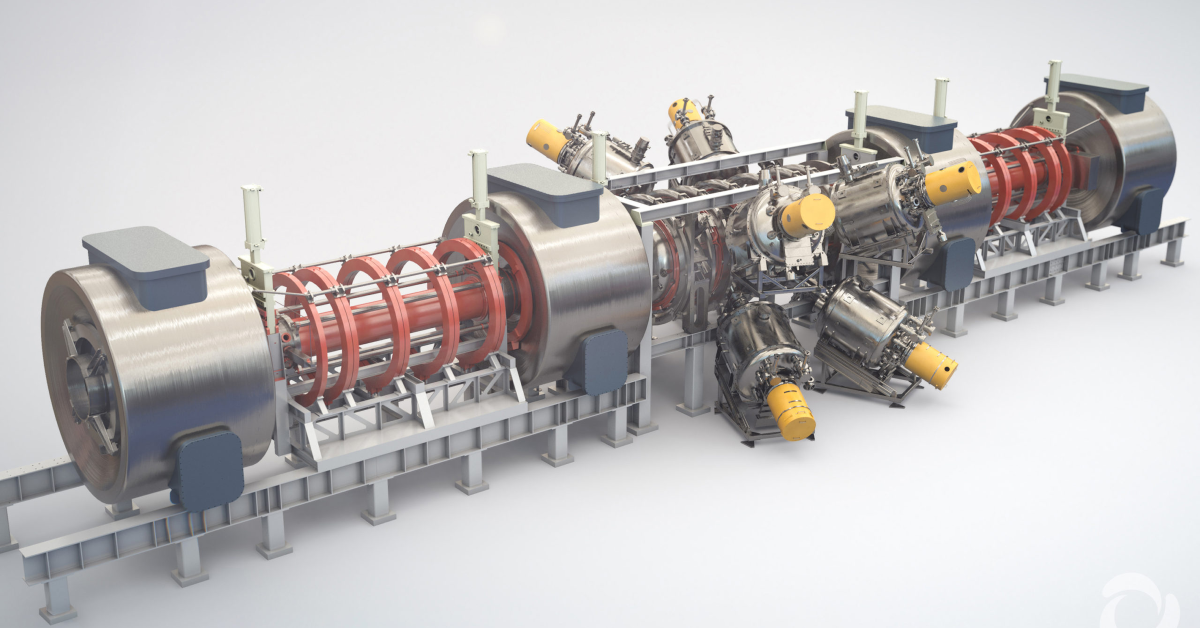

TAE Technologies' smoke ring technology explained

Harnessing fusion energy for utility-scale electricity requires confining plasma at “hot enough” temperatures for a “long enough” amount of time to enable fusion reactions.

TAE’s current platform “Norman,” is named in honor of the late Norman Rostoker, the company's co-founder.

“This is an incredibly rewarding milestone and an apt tribute to the vision of my late mentor, Norman Rostoker,” said TAE CEO Michl Binderbauer. “Norman and I wrote a paper in the 1990s theorizing that a certain plasma dominated by highly energetic particles should become increasingly better confined and stable as temperatures increase. We have now been able to demonstrate this plasma behavior with overwhelming evidence. It is a powerful validation of our work over the last three decades, and a very critical milestone for TAE that proves the laws of physics are on our side.”

Several other companies are working to commercialize fusion for energy because it promises to provide inexpensive electricity with virtually no carbon footprint. However, the struggle has been in reaching and sustaining the extremely high temperatures required.

TAE Technologies’ valuation

TAE has raised over $880 million from a slew of investors, including Google, Vulcan, Venrock, NEA, Wellcome Trust, and the Kuwait Investment Authority. Although its current valuation is unknown, in May 2019, the company was valued at $2.6 billion.

A portion of the new capital will be used to build “Copernicus,” a demonstration facility that will operate well over 100 million degrees Celsius to simulate net energy production.

Other funds will help commercialize TAE’s revolutionary Power Management technology, which can extend the range, efficiency, and speed of charging of electric vehicles. There are also plans for the technology to eventually be used in residential, commercial, industrial, and utility-scale electrical grid applications.

Dr. Michl Binderbauer

“As we shift out of the scientific validation phase into engineering commercial-scale solutions for both our fusion and power management technologies, TAE will become a significant contributor in modernizing the entire energy grid,” said Binderbauer.

How to invest in TAE Technologies

Currently, TAE Technologies is a private company that isn’t publicly traded on the stock market. Until the company moves forward with an IPO, you can’t invest in the stock.