Spotify Versus Apple: Antitrust in the EU, Explained

The EU seems to be in agreement with Spotify: Apple is acting against competition laws. The EU Commission has launched an official investigation.

April 30 2021, Published 11:04 a.m. ET

Nearly two years ago, Spotify complained to the European Union (EU) that Apple is in breach of EU antitrust laws governing competition in the market.

While they have yet to make an official decision, the EU Commission reports that they think that Apple holds the "dominant position in the market for the distribution of music streaming apps through its App Store." For that reason, they're launching an official investigation.

Apple App Store versus Spotify, explained

Spotify has had it out for Apple for a while, and the company isn't alone. Spotify is one of 47 companies within the Coalition for App Fairness, which is a growing community that fights for competitive fairness through 10 key principles.

Now, Spotify's case has gained enough steam to be officially picked up by the EU. The main concern is Apple's 30 percent commission for all in-app purchases. Also, Apple forbids apps from advertising other places to purchase items outside of the App Store, which reduces competition as well as a fair selection process for consumers.

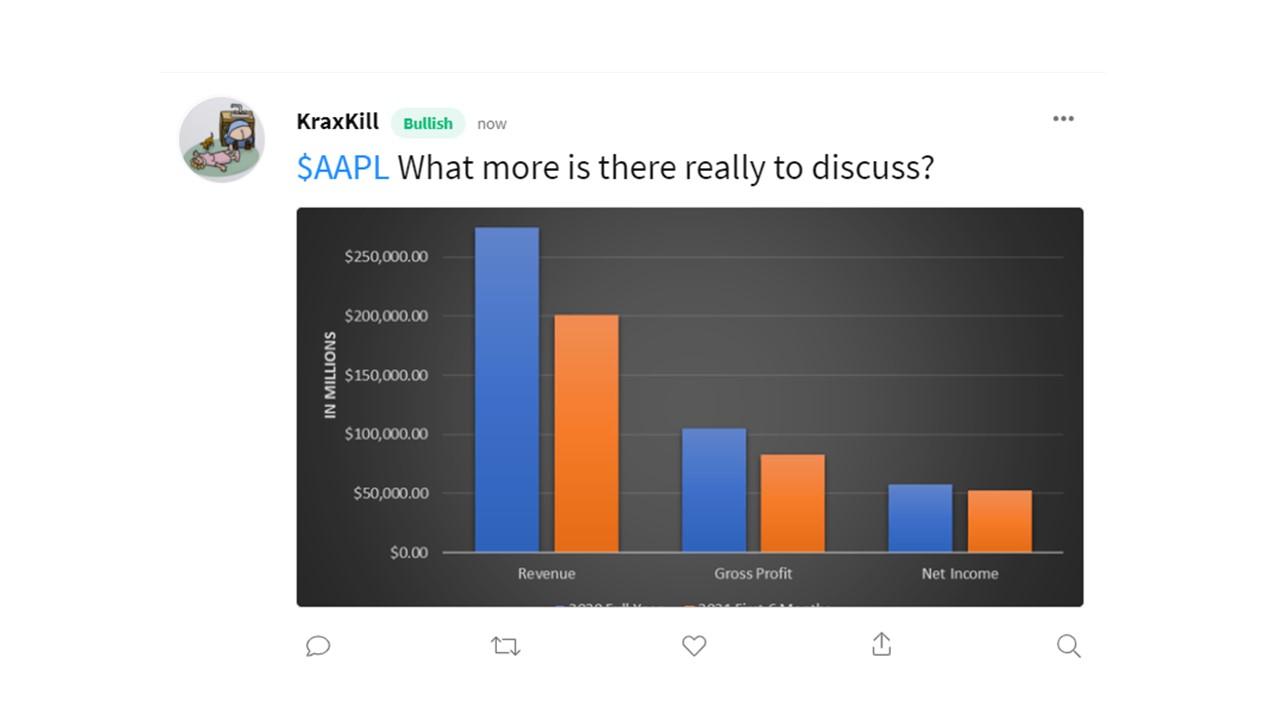

If Apple is found guilty of the antitrust charges brought against it, the company could pay a fine of up to 10 percent of its annual revenue.

The executive VP of the EU, Margrethe Vestager said in a statement, "By setting strict rules on the App store that disadvantage competing music streaming services, Apple deprives users of cheaper music streaming choices and distorts competition. This is done by charging high commission fees on each transaction in the App store for rivals and by forbidding them from informing their customers of alternative subscription options."

A forecast for Apple (AAPL) stock

Apple (NASDAQ:AAPL) is trading at $133.30 as of mid-morning on April 30. The shares are down 2.6 percent as of the market open on April 29. The company just smashed its earnings, and it isn't a stranger to antitrust investigations. With that in mind, Apple could easily see growth in the near term. Apple set options contracts wisely with EU timeframes in mind because 10 percent of its revenue is a lot to lose.

Best price to buy Apple (AAPL) stock

Getting in on Apple at $122 would be a good mid-range if you can swing it. Anything above $130 right now adds additional risk but with the company's positive earnings in mind, you could still do well.

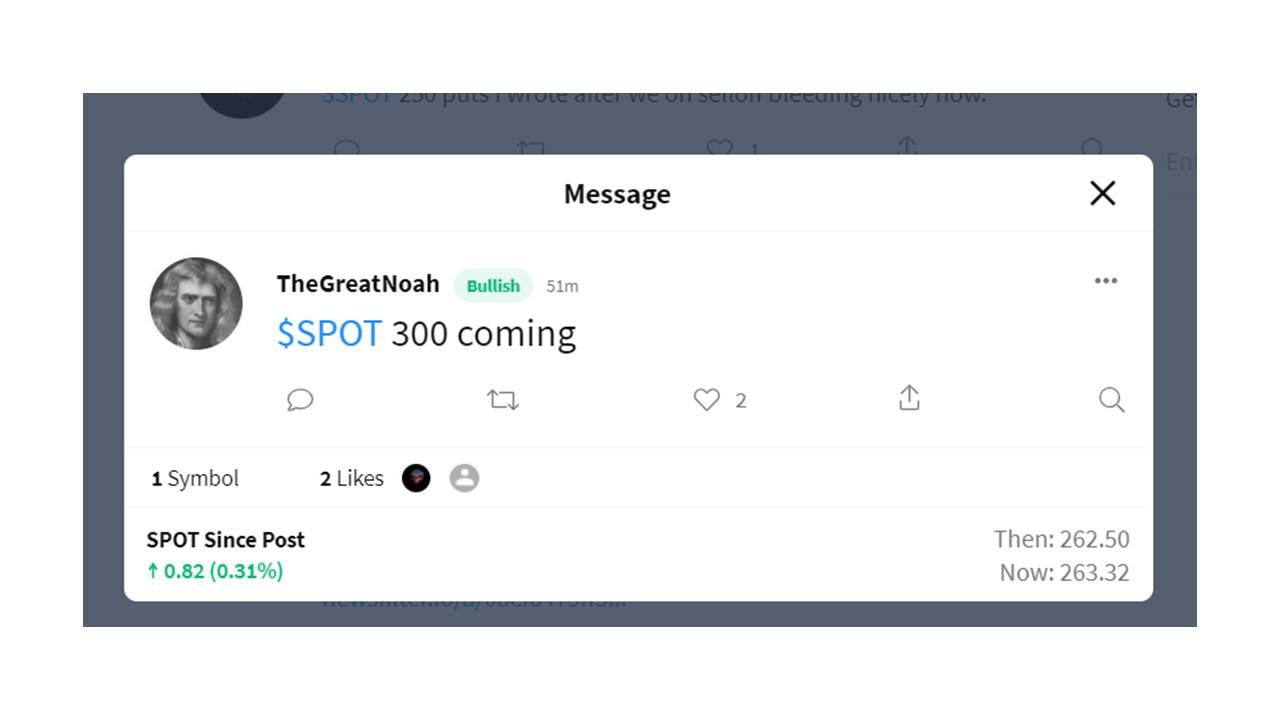

Spotify (SPOT) stock forecast

Spotify (NYSE:SPOT) shares are up 1.6 percent since the market open, but this week has been rough on the stock given subpar earnings. Shares tumbled 10 percent on April 27 after evidence that growth is slowing. The current antitrust situation for Apple could renew enthusiasm in Spotify, but enter wisely with long-term in mind.

Best price to buy Spotify (SPOT) stock

With shares currently trading at nearly $264 a pop, get in before the price goes up. Spotify's recent bear run creates a prime entrance for new investors as well as options traders seeking a higher strike price.