Social Security Sets a New Disability Earnings Limit in 2022

Social Security sets limits for earnings each year for disabled people to continue receiving disability benefits. What are new earnings limits for 2022?

Jan. 14 2022, Published 12:02 p.m. ET

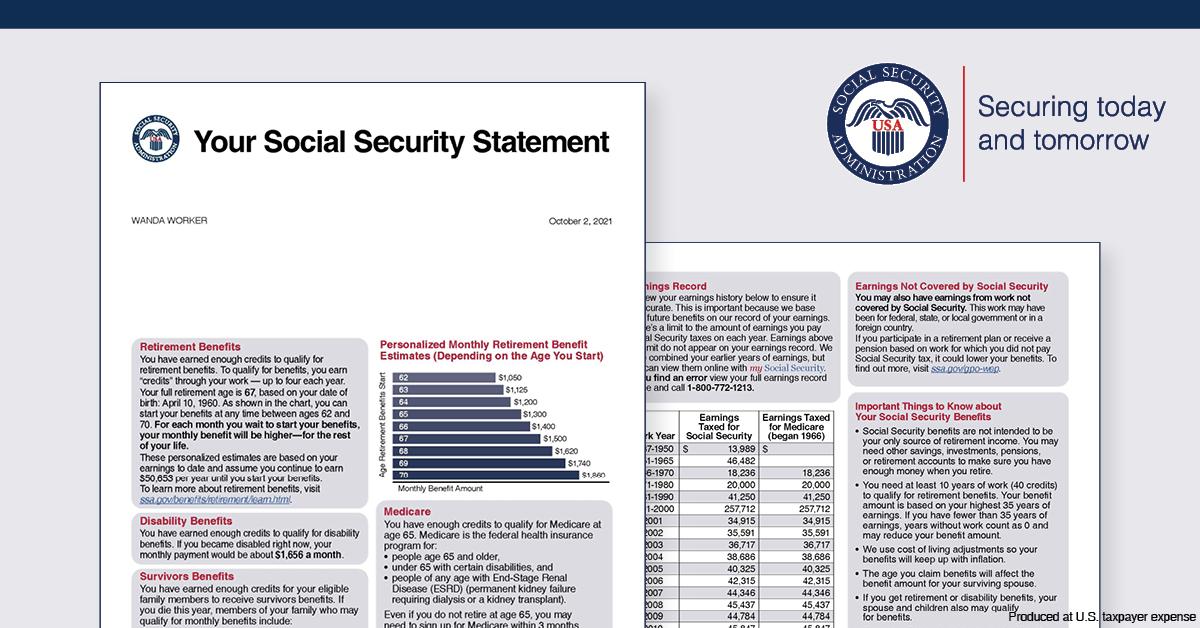

For people who are receiving Social Security disability payments and still earning income, it’s important to know what the earnings limit is. The Social Security Administration caps the maximum amount a disabled person can earn in a given year to remain eligible for disability benefits. Each year, the earnings cap changes.

In 2022, the new earnings limit for SGA (Substantial Gainful Activity) is $1,350 per month. That’s an increase of $40 per month from 2021 when earners were limited to $1,310 monthly. SGA refers to the amount that a disabled person is still able to earn without losing their disability benefits from the Social Security Administration.

What's the disability earnings limit for the blind and non-blind?

The SGA, or earnings per month, must fall beneath the allotted amount for the individual to receive full disability payments. The 2022 limit of $1,350 applies to disabled individuals who are sighted.

There's a higher limit for blind individuals. They must stay below the monthly earning level of $2,260 (an increase from $2,190 monthly in 2021).

What if you earn more than the limit?

Earning more than the maximum allowable amount for the year will result in you losing disability benefits. However, losing the disability benefits might be temporary. Some disabled workers might earn more than the maximum for a month or two, but once their income returns to the lower level, the benefits will be reinstated.

The benefits exist to help disabled individuals financially while they aren't able to perform tasks necessary to earn a living. Earning more than the limit indicates to the Social Security Administration that your disability doesn't hinder your ability to earn an income anymore.

Who qualifies for Social Security Disability Insurance?

Not every disabled person qualifies for Social Security Disability Insurance. For a person to qualify for the benefits, they must fulfill several requirements. As the Social Security Administration explains, the following requirements must be met:

- You must have worked in a job covered by Social Security.

- You must have a medical condition meeting the SS definition of “total” disability.

- You must have sufficient work credits from working long enough and recently enough.

- You earn less than $1,350 per month ($2,260 if blind).

The Social Security Administration might also determine that you aren't eligible for disability benefits if you’re able to perform work tasks, even if they're different from those at your previous job. The SSA considers a qualifying disability one that causes you to be significantly limited in ability to do work-related tasks for at least 12 months.

What's a Trial Work Period?

Social Security also provides for a TWP (Trial Work Period), which allows disabled individuals to attempt returning to the workforce. The program enables someone to test whether they're physically and mentally capable of going back to work without the threat of losing disability benefits.

A TWP can consist of up to nine months of work over a five-year period. The nine months don’t have to be completed consecutively. For 2022, earnings of $970 will trigger a TWP month.

An EPE (Extended Period of Eligibility) is also allotted for 36 months after the TWP is over. Some benefits can continue during this period if certain conditions are met.