Cashing Out Your 401(k) to Pay Off Debt—Consider Alternatives First

Cashing out your 401(k) to pay off debt comes with consequences. What are the pros and cons? In some cases, cashing out your 401(k) might make sense.

Dec. 8 2021, Published 2:08 p.m. ET

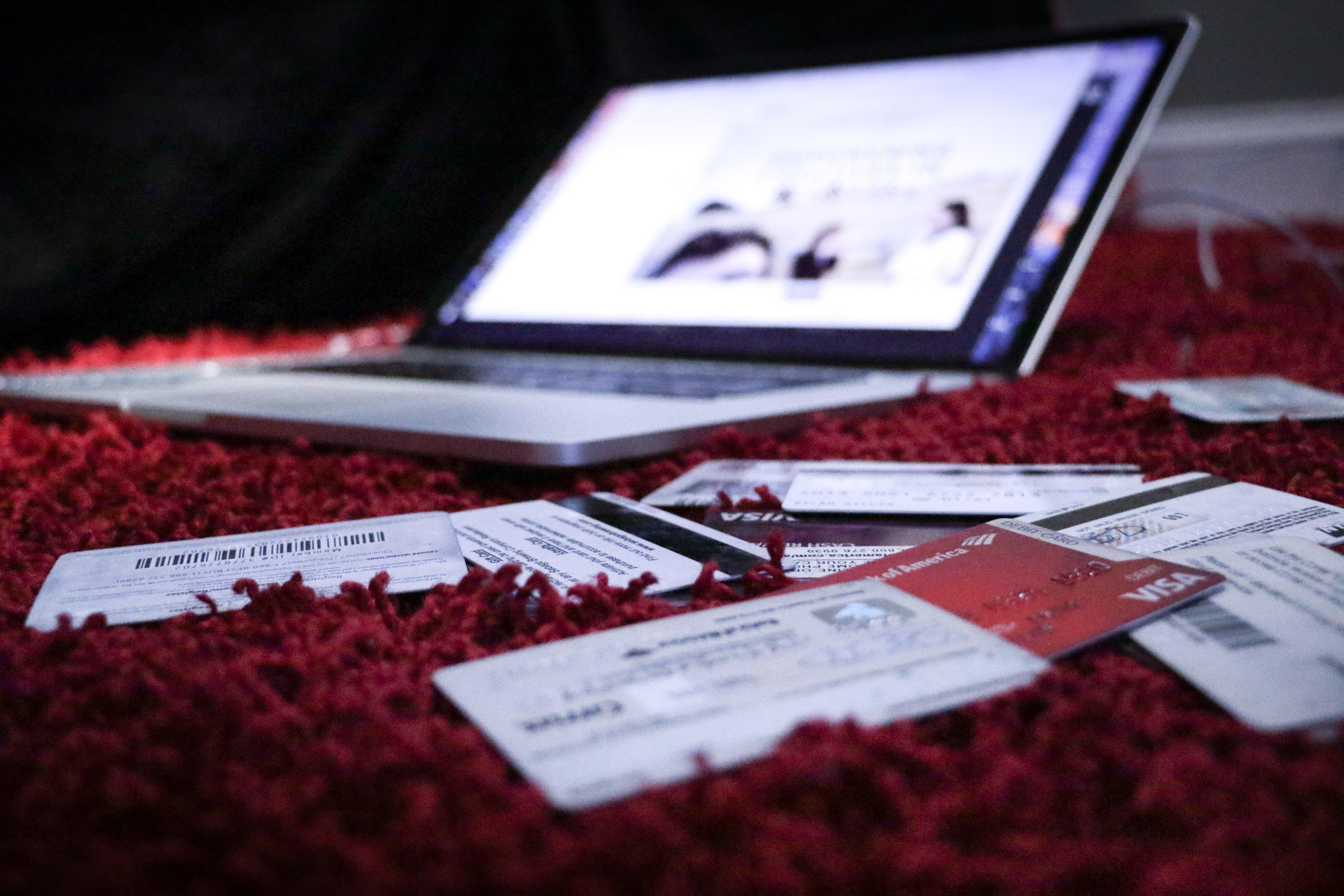

Not all debt is created equal. Student loans, credit cards, mortgages, and more can all burden your bank accounts. You might be tempted to cash out your 401(k) or other retirement funds to eliminate that debt once and for all.

Before you do, there are consequences that come with cashing out your 401(k). Here's a rundown of what to expect so you can make an educated decision on whether or not to use your retirement savings to pay off debt.

There are tax consequences for withdrawing your 401(k) before age 59.5.

If you withdraw your 401(k) money before age 59.5, you will have to pay a 10 percent early withdrawal fee. You can get this penalty waived if you're dealing with a specific hardship (like medical bills, housing, higher education, or permanent and total disability).

Individuals with a traditional 401(k) will also have to pay income tax based on their current tax bracket. A Roth 401(k) is filled with post-tax dollars, which means that you have already paid income taxes on your contributions.

These penalties are important to know because a $50,000 withdrawal could amount to a little over half as much once income taxes and withdrawal penalties go into effect.

What happens if you cash out your 401(k) after age 59.5?

If you want to cash out your 401(k) after age 59.5, you're free from the 10 percent withdrawal penalty. However, you'll still have to pay income taxes on a traditional 401(k).

If you have had a Roth 401(k) for at least five years, you won't have to pay any taxes on your money.

Using your 401(k) funds might make sense for debts with high interest rates.

Not all debts are created equal. For example, credit cards have high interest rates around 20 percent, and failing to pay your bills in full will only put you further in debt. In a high-interest situation like this, cashing out a portion of your 401(k) might make sense, but it's important to run the numbers to make sure you can actually get yourself in the green. You will also want to explore all other options before deciding to do this.

In most cases, you should not cash out your 401(k) to pay off low-interest debt since it likely won't be in your best financial interest.

Try other ways to pay off debt and leave the 401(k) as a last resort.

Cashing out your 401(k) early could lead you to pay a boatload in taxes and penalties.

Here are a few options to consider before deciding to pursue a 401(k) withdrawal:

If you have credit card debt or other high-interest debt, call the company to negotiate your interest rate. Borrowers with decent credit can often secure a lower interest rate.

For credit card debt, you can transfer your balance to another credit card with lower interest. You have to pay the transfer fee if applicable. You should prioritize cards with a zero percent interest period to help pay your debt off.

- Consolidate or refinance any loans to get a better interest rate.

- If none of that works, consider a 401(k) loan, which works differently than a withdrawal. You must pay the loan (including interest) in full by the time it's due, or if you leave your current job, the IRS might deduct the money from your 401(k) as a regular withdrawal.