Four Robo-Advisors That Offer the Best Returns

If you are mainly interested in robo-advisors that are going to provide you with the best returns, here are four of the top-performing applications.

June 4 2021, Published 3:24 p.m. ET

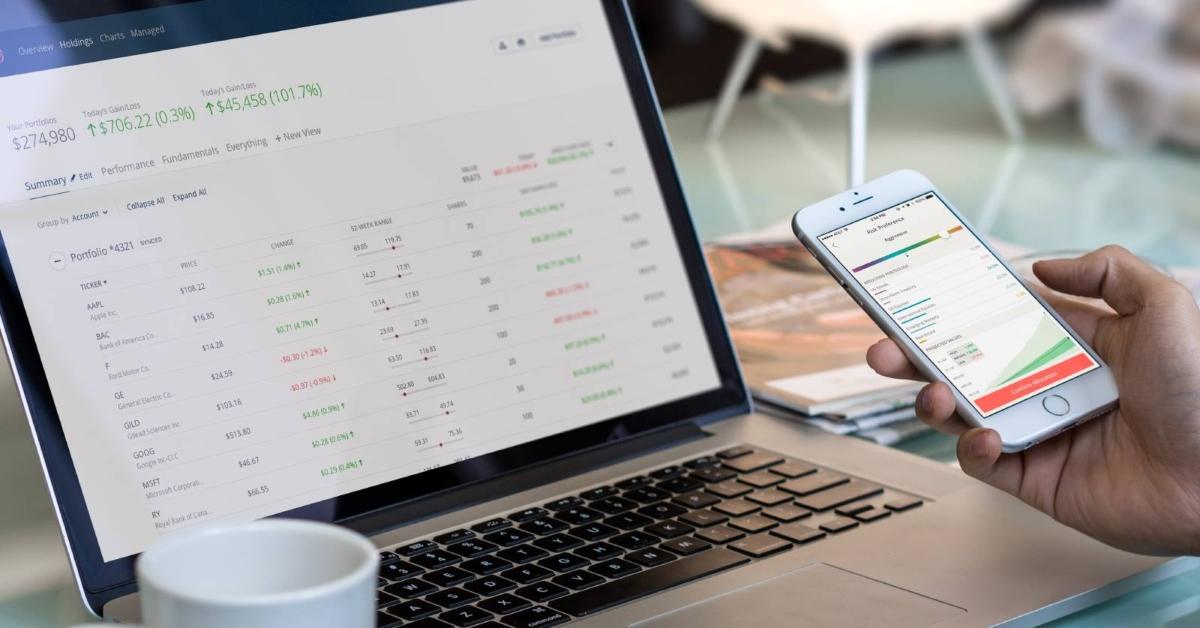

Using a robo-advisor for investing is an attractive option, especially for beginners with little knowledge of investing. Robo-advisors, which are offered online or through mobile apps, can also have lower fees than traditional financial advisors.

According to the website Statista, the number of investors using robo-advisors is expected to grow to over 16,000 by 2025. In 2021, the average AUM (assets under management) through robo-advisors per user is expected to reach $85,613.

When considering which robo-advisor is best for your needs, there are several factors to consider, such as:

Management fees

Account minimums

Expense ratios

Available advising

Portfolio makeup

Annual returns

Robo-advisors that offer the best returns

If you are mainly interested in robo-advisors that are going to provide you with the best returns, here are four of the top-performing applications:

SigFig

SigFig offers one of the highest 2.5-year annualized returns at 4.71 percent. Although the minimum deposit required to start investing with this site is a bit high at $2,000, the management fee is zero percent for up to $10,000. That fee increases to 0.25 percent for accounts over $10,000. SigFig also has one of the higher average expense ratios at 0.15 percent. When you invest with SigFig, the robo-advisor doesn’t hold any of your assets. Instead, it manages your account through TD Ameritrade.

SoFi Automated Investing

Beginner investors or those who want to “set it and forget it” will like the features in SoFi Automated Investing. You can start investing with as little as $1 with a zero percent management fee. The average expense ratio is also one of the lowest at 0.08 percent. Users also get free access to SoFi financial advisors, free career counseling, and discounts on loans. SoFi only offers five different risk levels and portfolios that are less customizable than other programs. Real people behind the scenes actively manage its portfolios. SoFi has a 2.5-year annualized return of 4.03 percent.

Axos Invest

With a minimum investment of $500, you can open an investing account with Axos Invest. It charges a 0.24 percent management fee and the average expense ratio is 0.12 percent. Axos doesn’t offer readily available human advisors. Its goal-based approach to investing allows you to set milestones to work toward with your investing. Axos Invest’s Portfolio Plus feature enables you to customize your portfolio at no additional fee. You can also invest in different sectors, like socially-minded companies. The program offers tax-loss harvesting as a standard option. The 2.5-year annualized return on Axos Invest is 4.38 percent.

Fidelity Go

Fidelity Go is a good option for users who already have an IRA or a taxable account with Fidelity Investments. Portfolios are built with Fidelity Flex mutual funds. There isn't a required minimum to open an account, but you will need to fork out $10 to start investing. As long as your account is less than $10,000, there aren't any management fees. For over $10,000 up to $49,999, the cost is $3 per month. Accounts over $50,000 are subject to a management fee of 0.35 percent per year. There aren't any expense ratio costs with Fidelity Go because those costs are included in the management fees. Portfolios are rebalanced regularly and the 2.5-year annualized return is 3.88 percent.