Roaring Kitty of WallStreetBets: Net Worth as Options Contracts Expire

At the head of the GameStop debacle is Keith Gill, also known as Roaring Kitty of WallStreetBets. His net worth speaks volumes of his trading strategy.

April 16 2021, Published 10:39 a.m. ET

Keith Gill, also known by his YouTube name Roaring Kitty, has already been subpoenaed by Massachusetts state regulators for his influence on the GameStop (NYSE:GME) short squeeze. Now, they're going after his former employer MassMutual. Gill resigned from the company in January. As his net worth amasses following options contract expirations, more people are learning his name.

So what's under the covers for Roaring Kitty's earnings?

How much Roaring Kitty has made on GameStop

So far, Roaring Kitty's enthusiastic live stream YouTube videos, paired with his presence as "DeepF——Value" on Reddit's WallStreetBets, has made him practically a household name for anyone privy to the GameStop news.

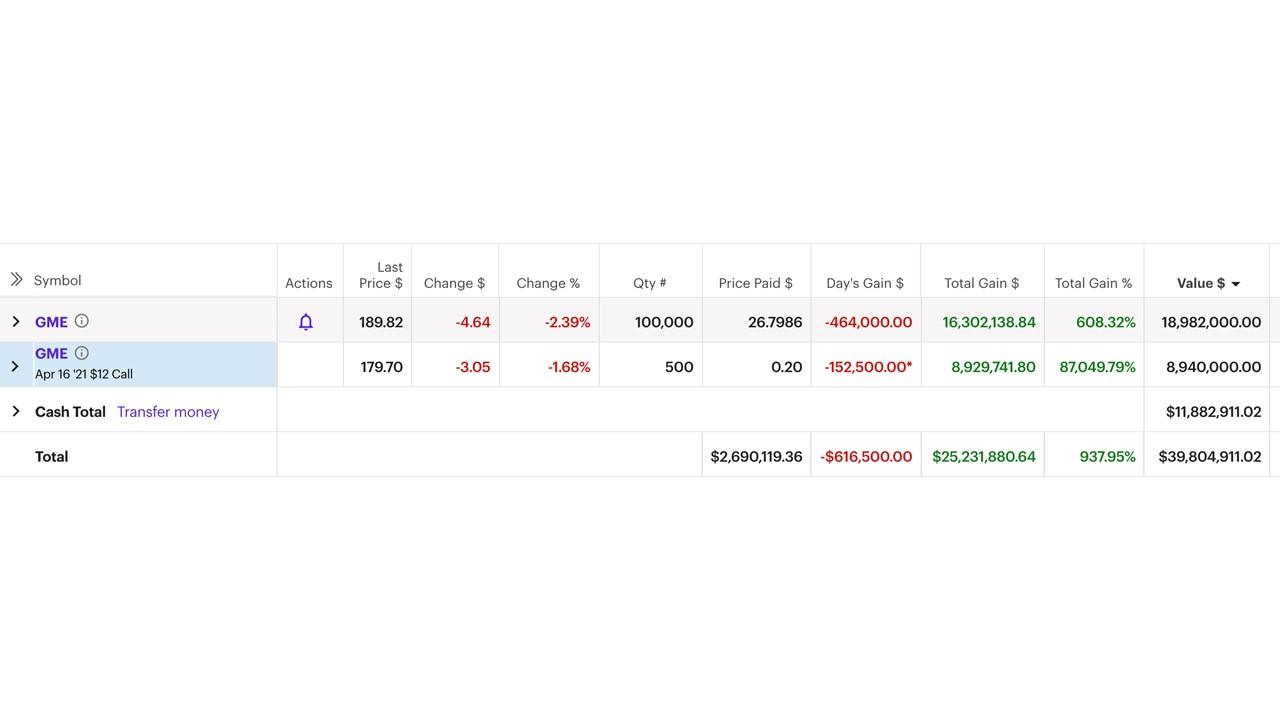

At the beginning of 2021, Gill added to his GameStop investment with 500 new options contracts, which he set for an April 16 expiration.

Initially, he purchased the contracts for a total of $10,000. After setting a $12 strike price for a call option, GameStop's current share price of $156.44 is way past the minimum. Gill could pocket nearly $7.3 million from this bundle of contracts alone, and it isn't even his entire GameStop portfolio. However, he might have already acted out the contracts.

Gill is being investigated for potential market manipulation because of the sweeping following he amassed online, which ultimately helped send GameStop stock more than 1,000 percent higher over a two-week period despite downward pressure from institutional short sellers.

Roaring Kitty's overall net worth is even higher

Aside from the more than $7 million options contract gain, Gill presumably is still holding on to his 100,000 GameStop shares (90 percent of which he purchased in 2020). The average cost basis for these shares is just under $27 each based on his own reported screenshots of his brokerage account. If he sold those now, he would amass about a 608 percent return or nearly $19 million.

Combined with his options payout, that's approximately $26.3 million.

Gill's screenshot also boasted a cash total of $11.8 million, which he could keep liquid or reinvest to capitalize on.

Gill's portfolio of GME is by no means diversified, but it's possible that he holds other investments elsewhere. This would add to his net worth, as well as any equity or assets he held prior to the GameStop stock movement.

Roaring Kitty's GameStop option call is a bold move, but it's paying out.

As a former licensed broker for MassMutual, Gill has made a full-on transformation in how he approaches investing. His fanbase is loyal, all 522,000 YouTube channel subscribers and much of the 9.8 million WallStreetBets readers who tout his genius. It's undeniable that he has influenced the market, but whether or not that can be considered market manipulation is still up for debate.

If anything, he has brought a whole new sector of retail investors out of their shells and paved the way for the "loss porn" movement full of day traders who weren't quite as lucky as him.